Advertiser Disclosure

Last update: October 14, 2025

6 minutes read

What Is Micro-Investing? The $5 Investment Strategy Taking Over College Campuses

Wondering how to start investing with just $5? Learn how micro-investing apps help college students build wealth with spare change. Compare platforms, fees, and get started today.

By Derick Rodriguez, Associate Editor

Edited by Brian Flaherty, B.A. Economics

Learn more about our editorial standards

By Derick Rodriguez, Associate Editor

Edited by Brian Flaherty, B.A. Economics

Learn more about our editorial standards

Ever looked at your bank account after buying coffee and thought, "I wish I could invest that spare change instead of watching it disappear"? You're not the only one.

Micro-investing has become the go-to strategy for college students who want to start building wealth without needing a big lump sum of cash upfront.

This post breaks down everything you need to know about micro-investing, from how these apps actually work to whether they're worth your time as a student.

We'll explore the platforms that are changing how young people think about money and share practical tips for getting started with as little as $5.

Key takeaways

- Micro-investing lets you invest spare change from everyday purchases, making it perfect for students on tight budgets

- Popular apps like Acorns and Stash round up your purchases and invest the difference automatically

- You can start with just $5 and build investing habits without feeling overwhelmed by complex strategies

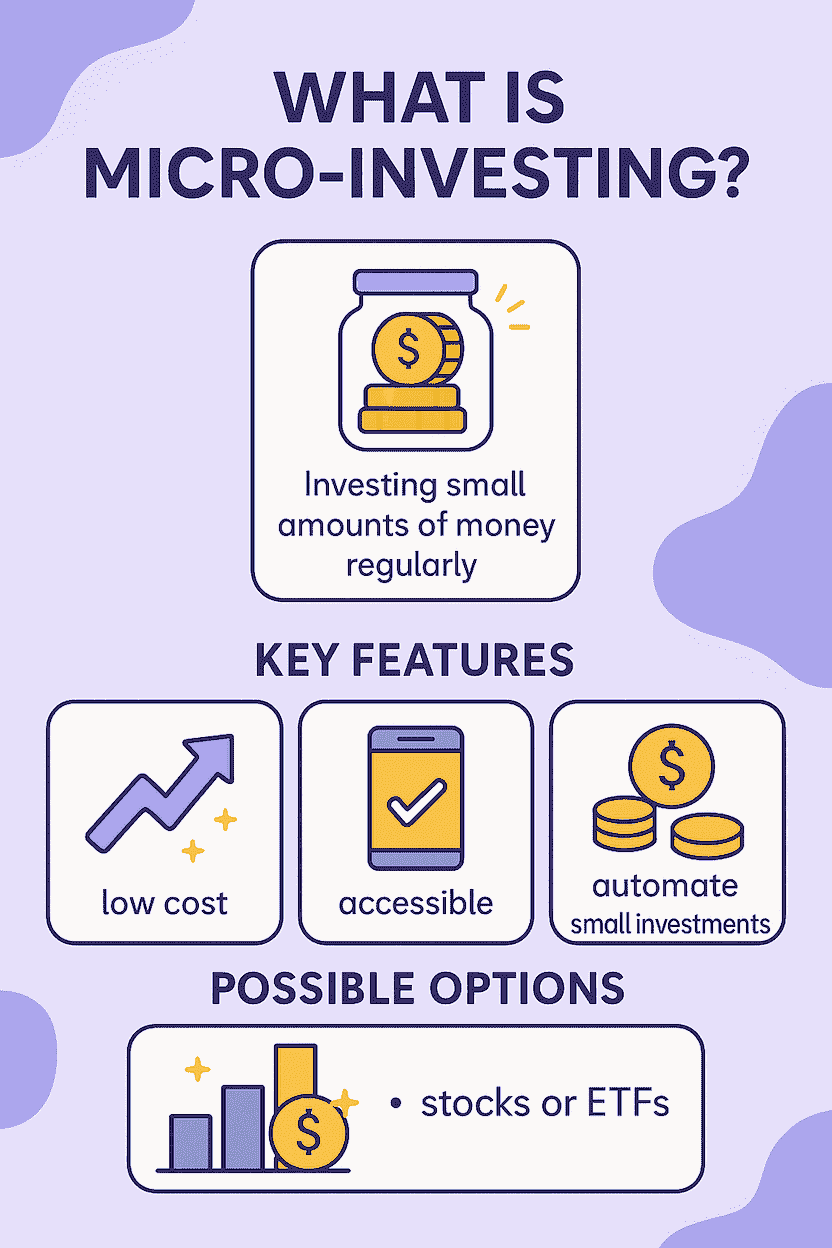

What is micro-investing?

Micro-investing takes the intimidation out of investing by letting you start building wealth with tiny amounts. Instead of needing hundreds or thousands of dollars upfront, you can begin building a portfolio with loose change from your daily spending.

I remember when I started investing for the first time. Looking at the blue-chip stocks I was thinking about purchasing, many of them cost hundreds of dollars just to buy a single share. If you’re a student on a tight budget, you might need to start smaller – and that’s what micro-investing is built for.

The concept is simple: invest small amounts regularly over time.

Your $4.75 latte becomes a $5 purchase, and that extra quarter goes straight into a diversified portfolio. Do this consistently, and those tiny investments add up faster than you'd expect.

TuitionHero Tip

Micro-investing works especially well for students because it fits naturally into existing spending habits. You're already buying textbooks, food, and supplies - now that spending can help build your future wealth too.

Most micro-investing platforms focus on exchange-traded funds (ETFs), which are like baskets containing dozens or hundreds of different stocks and bonds. This gives you instant diversification without needing to research individual companies.

The beauty lies in automation. Once you set it up, your investments happen without any effort on your part. Your money grows while you focus on classes, work, and everything else competing for your attention.

How micro-investing apps actually work

The mechanics are surprisingly straightforward. You link your checking account, credit card, or debit card to the app, and it monitors your transactions. When you make a purchase, the app rounds up to the nearest dollar and sets aside the difference.

Here's a typical week for a student using micro-investing:

- Coffee: $3.25 → rounds to $4.00 (75¢ invested)

- Textbook: $127.99 → rounds to $128.00 (1¢ invested)

- Lunch: $8.50 → rounds to $9.00 (50¢ invested)

- Gas: $22.10 → rounds to $23.00 (90¢ invested)

Total invested: $2.16 without even thinking about it.

Some platforms also let you make recurring investments - maybe $10 every week or $25 monthly. Others offer one-time boosts where you can add larger amounts when you have extra cash from a part-time job or birthday gift.

TuitionHero Tip

Start with just round-ups for the first month to see how much you naturally accumulate. This gives you a baseline for setting realistic recurring investment goals.

The apps typically invest your money in portfolios based on your risk tolerance and goals. Conservative portfolios have more bonds and stable investments, while aggressive ones lean heavily toward growth stocks.

As a college student with a long time until retirement, stock-focused ETFs might be the best fit. Sure, these funds can be volatile – but decades of compound growth can lead to serious wealth-building.

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

Best micro-investing apps for college students 2025

Acorns

Acorns dominates the micro-investing space and offers student discounts. The interface is clean, educational content is solid, and round-ups happen seamlessly. Monthly fees start at $3, but students may be able to access a bonus investment with their .edu email address.

Stash

Stash takes a slightly different approach, featuring personalized advice and professionally managed portfolios. Minimum investment is just $5, and they provide educational articles matched to your interests. Monthly fees start at $3. .

Qapital

Qapital focuses heavily on goal-based saving and investing. You can set targets like "Spring Break Fund" or "Post-Graduation Emergency Fund." Their round-up feature is more customizable - for instance, you can round up to the nearest 2 dollars or more for faster growth.

Robinhood

Robinhood isn't technically a micro-investing app, but its fractional shares feature lets you buy pieces of expensive stocks with small amounts. No monthly fees, though you miss out on automatic round-ups.

Platform | Basic Monthly Fee | Minimum Investment | Student Benefits |

|---|---|---|---|

Acorns | $3 | $5 | Potential bonus investment |

Stash | $3 | $1 | Investment education, personalized advice |

Qapital | $3 | $10 | Customizable round-ups, savings goals |

Robinhood | $0 | $1 | Commission-free trading, fractional shares |

Advantages and disadvantages of micro-investing

Like any financial tool, micro-investing has trade-offs worth considering before you jump in. Here's the honest breakdown:

- Low barrier to entry: Spare change investing removes intimidation factor

- Automatic habit building: Consistent investing through dollar-cost averaging

- Built-in financial education: Digestible content beats dense textbooks

- Fees eat into small balances: $1 monthly fee on $50 = 2% annually

- Modest returns: Growth on small amounts may not add up to much

- Passive learning trap: Automation can prevent active investment skills

TuitionHero Tip

Use micro-investing as training wheels, not your only investment strategy. As your knowledge and income grow, consider graduating to broader investment options.

How to start micro-investing with $5

Choose a platform based on your priorities. Want maximum automation? Go with Acorns. Prefer more control over individual investments? Try Stash or Robinhood. Looking for goal-based saving? Qapital might fit best.

Download the app and connect your primary checking account. Most platforms will ask about your financial goals, timeline, and risk tolerance. Be honest; there's no wrong answer, and you can adjust these settings later.

Start with just round-ups for your first month. This gives you a feel for how much you naturally accumulate and whether the fee structure makes sense for your spending patterns.

Set a realistic recurring investment if round-ups aren't adding up quickly enough. Even $5 or $10 weekly can make a meaningful difference over several years of college.

Monitor your progress monthly, not daily. Market fluctuations are normal and expected. Focus on building the habit rather than obsessing over short-term performance.

Do’s and don’ts of micro-investing

Do

Start small and build consistency

Take advantage of student discounts

Use it as a learning tool

Set realistic expectations

Review and adjust quarterly

Don't

Check your balance daily

Invest money you need for bills

Expect quick riches

Forget about fees

Panic during market dips

Why trust TuitionHero

At TuitionHero, we help you find the best private student loans by comparing top lenders and breaking down eligibility, interest rates, and repayment options. Whether you need additional funding beyond federal aid or a loan without a cosigner, we simplify the process. We also provide expert insights on refinancing, FAFSA assistance, scholarships, and student credit cards to support your financial success.

Frequently asked questions (FAQ)

Yes, if you view it as education rather than the only form of wealth building. The habits you develop and knowledge you gain are valuable, even if returns on small invested amounts are modest. Just don't expect it to pay off your student loans.

Historical returns for diversified portfolios average around 7-10% annually over long periods, but your actual returns will vary based on market conditions and fees. With small balances, fees have a bigger impact on net returns.

Legitimate platforms keep your investments separate from company assets. Your securities are protected by SIPC insurance up to $500,000, though not against market losses or other declines in the value of your investments. Even if the micro-investing company goes bankrupt, you still own the underlying shares.

Absolutely. All investments carry risk, and your account value will fluctuate with market conditions. However, diversified portfolios tend to grow over long time periods, which is why these apps work best as multi-year strategies.

No. Credit card debt typically charges 18-25% interest, while investment returns average much lower. Pay off high-interest debt first, then start investing.

Final thoughts

Micro-investing won't make you rich overnight, but it can make investing feel approachable and automatic. For students juggling classes, work, and social life, accessibility matters more than optimal returns.

The real value lies in building financial habits that will serve you well after graduation. Learning to invest consistently, understanding market basics, and getting comfortable with reasonable risk-taking are skills that compound over decades.

Remember, you have options beyond micro-investing apps. As your income grows and you become more knowledgeable, consider expanding into broader investment accounts, retirement funds, and other wealth-building strategies. TuitionHero's investment guides can help you navigate those next steps when you're ready.

Your future self will thank you for starting now, even if it's just with spare change from your morning coffee.

Source

Author

Derick Rodriguez

Derick Rodriguez is a seasoned editor and digital marketing strategist specializing in demystifying college finance. With over half a decade of experience in the digital realm, Derick has honed a unique skill set that bridges the gap between complex financial concepts and accessible, user-friendly communication. His approach is deeply rooted in leveraging personal experiences and insights to illuminate the nuances of college finance, making it more approachable for students and families.

Editor

Brian Flaherty

Brian is a graduate of the University of Virginia where he earned a B.A. in Economics. After graduation, Brian spent four years working at a wealth management firm advising high-net-worth investors and institutions. During his time there, he passed the rigorous Series 65 exam and rose to a high-level strategy position.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today

Compare Personalized Rates