Advertiser Disclosure

Last update: October 14, 2025

6 minutes read

What Is Round-Up Saving? Why Students Are Saving Spare Change Without Thinking

Could saving your coffee change add up to hundreds of dollars? Discover how round-up saving helps students build wealth automatically.

By Derick Rodriguez, Associate Editor

Edited by Brian Flaherty, B.A. Economics

Learn more about our editorial standards

By Derick Rodriguez, Associate Editor

Edited by Brian Flaherty, B.A. Economics

Learn more about our editorial standards

Remember the feeling of spare change in your pocket? It’s a lot more rare now that credit cards are so widespread. But surprisingly, that spare change might just be the secret to stress-free wealth-building – with a little help from the latest financial technology.

This post explains how round-up saving turns everyday purchases into painless wealth building, why college students are embracing this hands-off approach, and which platforms can help you start saving without changing how you spend.

Key takeaways

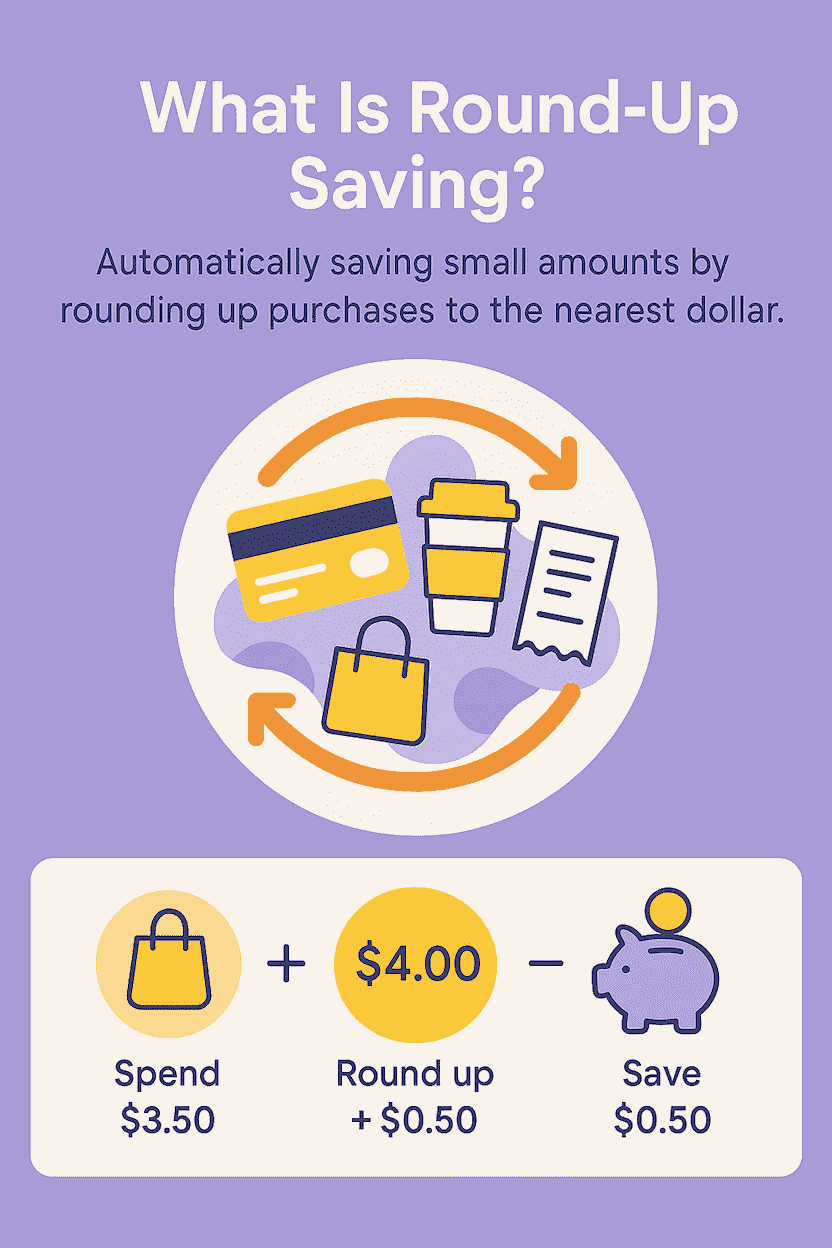

- Round-up saving automatically rounds purchases to the nearest dollar and saves the difference

- College students might be able to save over $300 annually without feeling the financial impact

- The method works because it operates below your conscious spending awareness

How does round-up saving work?

Round-up saving platforms connect to your debit card or checking account and monitor every purchase you make. Buy a textbook for $127.43? The system rounds up to $128.00 and transfers that extra $0.57 into a separate savings or investment account.

The magic happens without any effort on your part. Every coffee run, gas fill-up, or grocery trip automatically generates a small deposit. Most platforms process these transfers within 1-3 business days.

Many services let you amplify your savings, too. Instead of saving just the spare change, you can multiply it by 2x, 5x, or even 10x. That $0.57 textbook round-up becomes $5.70 in your account.

The psychological aspect is huge. You're spending the money anyway, so the round-up feels free. Your brain doesn't register losing $127.43 versus $128.00.

TuitionHero Tip

Start with basic 1x round-ups for your first month to gauge how much you naturally save before increasing the multiplier.

Why students are choosing automatic spare change saving

Traditional saving advice falls flat for students juggling tuition, rent, and part-time jobs. "Save 20% of your income" sounds impossible when your income fluctuates every month and you never know when a surprise bill is going to pop up.

Round-up saving sidesteps this problem entirely. You don't need to find extra money in your budget or make conscious decisions about how much to save. The system captures money that would otherwise disappear into the digital ether.

The amounts feel insignificant in isolation. Saving $0.73 here and $1.12 there doesn't trigger the same budget anxiety as transferring $50 to savings. Your spending habits stay exactly the same.

But over the months and years, even these small amounts can add up. Imagine that you can save just $5 per week in spare change by rounding up.

Over the course of a year, that’s $260 – over five years, it’s $1,300 in savings, all without changing your habits.

The automation also removes decision fatigue. You don't have to remember to save or debate whether you can afford it this month.

TuitionHero Tip

Pair round-up saving with a high-yield savings account to earn interest on your accumulated spare change.

Top round-up apps and bank accounts in 2025

Traditional bank options

- Bank of America's Keep the Change rounds up debit purchases and moves the difference to your savings account. The service is free, but you'll need both checking and savings accounts with them.

- Ally Bank features an option to round up spending to the nearest dollar. Once you’ve accumulated $5, that amount is transferred to a savings account.

- SoFi also features round ups through the bank's debit card, in coordination with their Vault goal-setting feature.

Fintech round-up apps

- Acorns pioneered round-up investing by putting your spare change into diversified stock and bond portfolios. Plans cost $3-12 monthly, depending on features.

- Qapital combines round-up saving with goal-based investing. You can save for specific targets like spring break or a laptop. Monthly fees range from $3-12.

- Stash rounds up purchases and invests the money while teaching you about personal finance. Plans start at $3 monthly for basic features.

Platform | Monthly Cost | Where Money Goes | Best For |

|---|---|---|---|

Bank of America | Free | Savings account | Basic savers |

Acorns | $3-12 | Stock/bond ETFs | Beginner investors |

Qapital | $3-12 | Goals-based savings | Target savers |

Stash | $3-9 | Individual stocks/ETFs | Learning investors |

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

Hidden costs and drawbacks you should know about

- Monthly fees can quickly erode your savings, especially if you're only setting aside small amounts. Paying $3 to save $20 means losing 15% to fees before you even consider investment returns.

- Some apps have withdrawal restrictions or selling fees that can trap your money when you need it most. Always check how quickly you can access your funds.

- Round-up saving can create a false sense of financial security. Saving $25 monthly feels good, but it won't cover emergency expenses or significant goals like study abroad programs.

- The automation can also make you less mindful of spending. When every purchase gets "rounded down" in your mind, you might spend more carelessly than you would otherwise.

- Technical glitches occasionally cause double-charges or failed transfers. While customer service usually fixes these issues, they can temporarily mess up your budget.

TuitionHero Tip

Calculate whether fees make sense for your saving level. If you're saving less than $30 monthly, free bank options often work better than paid apps.

Tips to maximize your round-up returns

- Choose the right multiplier carefully. Start with 1x round-ups and increase only if your budget can handle larger transfers without causing overdrafts.

- Use a fee-free checking account. Some banks charge for excessive transfers, which can add up when you're making multiple small round-up transactions.

- Set up automatic transfers too. Round-ups work best as a supplement to regular saving, not a replacement for intentional budgeting.

- Monitor your progress monthly. Seeing your balance grow can motivate you to find other small ways to save money.

- Consider your timeline for the money. Use round-ups for emergency funds if you need quick access, or investment accounts if you won't need the money for years.

- Track spending patterns. If round-ups are encouraging overspending, you might need to scale back or switch to manual saving methods.

Do's and don'ts of round-up saving

Do

Start with free options first

Set minimum balance alerts

Check account activity regularly

Use with high-yield savings

Don't

Pay high fees for small amounts

Let it replace budgeting entirely

Assume all platforms are the same

Forget about withdrawal restrictions

Why trust TuitionHero

At TuitionHero, we help you find the best private student loans by comparing top lenders and breaking down eligibility, interest rates, and repayment options. Whether you need additional funding beyond federal aid or a loan without a cosigner, we simplify the process. We also provide expert insights on refinancing, FAFSA assistance, scholarships, and student credit cards to support your financial success.

Frequently asked questions (FAQ)

Students can potentially save $200-500 per year through basic round-ups, depending on spending frequency. Using multipliers can increase this to $1,000+ annually.

No, round-up saving only involves your checking and savings accounts, which don't directly impact credit scores.

Most apps will skip the transfer rather than cause an overdraft, but policies vary. Check your platform's specific rules.

Technically yes, but you risk double-rounding the same purchase and creating budget confusion. Stick with one primary platform.

Money sitting in savings accounts isn't taxable, but investment gains from apps like Acorns may generate tax obligations when you sell.

Final thoughts

Round-up saving offers a painless entry point into building wealth, especially for students who struggle with traditional budgeting advice. While it won't single-handedly solve your financial challenges, it can provide a foundation for better money habits.

The key is matching the right platform to your needs and treating round-ups as one piece of a broader financial strategy. Whether you keep your spare change in a simple savings account or invest it for long-term growth, the most important step is starting.

Small amounts saved consistently can grow into meaningful sums over your college years and beyond. TuitionHero's budgeting tools can help you identify other opportunities to save while you're building your round-up nest egg.

Source

Author

Derick Rodriguez

Derick Rodriguez is a seasoned editor and digital marketing strategist specializing in demystifying college finance. With over half a decade of experience in the digital realm, Derick has honed a unique skill set that bridges the gap between complex financial concepts and accessible, user-friendly communication. His approach is deeply rooted in leveraging personal experiences and insights to illuminate the nuances of college finance, making it more approachable for students and families.

Editor

Brian Flaherty

Brian is a graduate of the University of Virginia where he earned a B.A. in Economics. After graduation, Brian spent four years working at a wealth management firm advising high-net-worth investors and institutions. During his time there, he passed the rigorous Series 65 exam and rose to a high-level strategy position.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today

Compare Personalized Rates