Advertiser Disclosure

Last update: December 11, 2025

Private student loans made easy

TuitionHero has your back with simple explanations and comparisons to help you make confident financial decisions.

Compare top lenders

Since 2019, we've helped over 500,000

students make informed decisions about financing their college education.

What are Private Student Loans?

Private student loans are used to pay for college-related expenses while in school and can be a great option to cover whatever's left over after taking out federal student loans. Rather than being funded by the government, private student loans are offered by a credit union, bank, or online lender.

Who is eligible for private student loans?

Almost anyone can apply for private student loans, regardless of financial status or academic performance. However, each lender has different requirements, so it's important to compare your choices carefully.

How much can you take out in private student loans?

With most lenders, you’re eligible to borrow up to the total cost of attendance for your school. With that being said, how much you can actually borrow may vary based on various factors.

How long does it take for private student loans to be disbursed?

Getting the money from your private student loan usually takes a few weeks, but it depends on which lender you choose. To get your money faster, make sure to respond quickly if the lender asks you for anything.

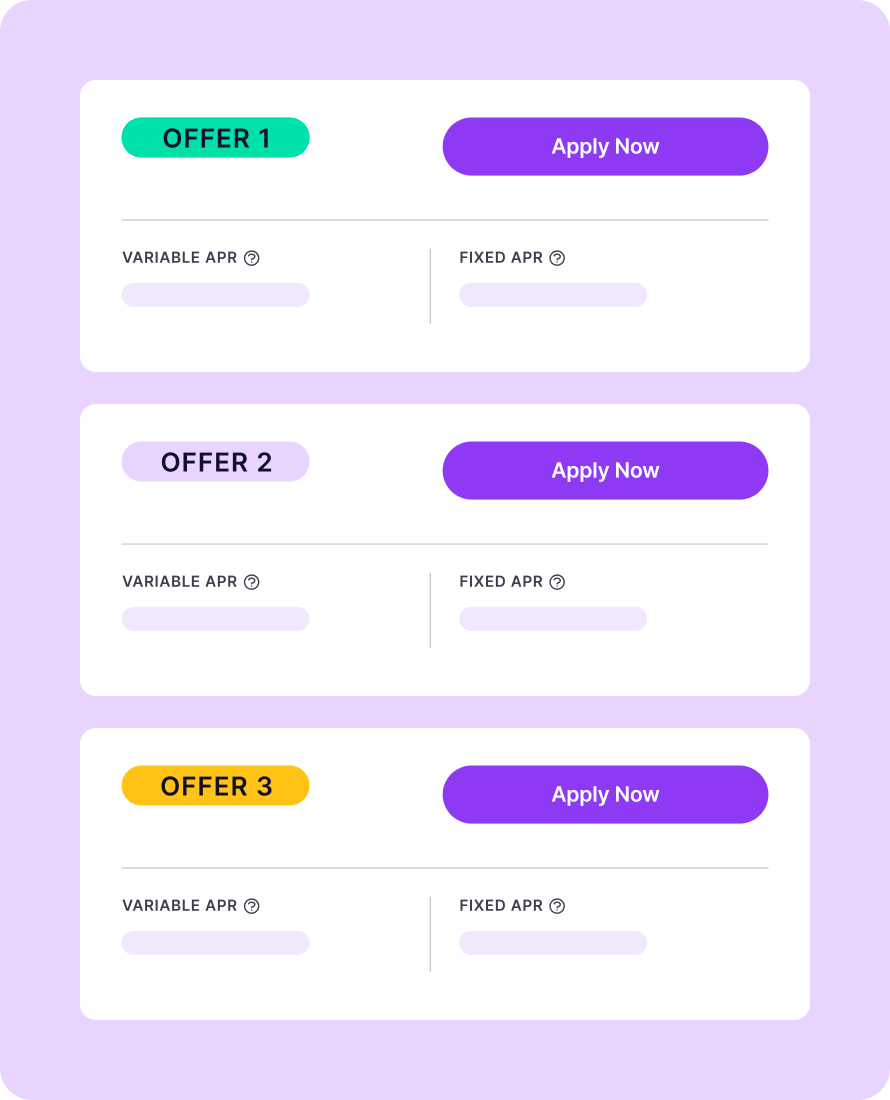

TuitionHero's best student loan offers for December 2025

This month, we have a variety of student loan options. We've partnered with top lenders to help make your goals for higher education a reality!

What's the difference between federal and private student loans?

Both federal student loans and private student loans can be used to help you pay for school. Here are the differences between these two kinds of loans:

Federal student loans

A federal student loan is an education loan funded by the government, typically through the Department of Education.

Great for students who:

- Have limited income or credit history

- Want a fixed interest rate that won’t go up or down

- Need flexible repayment options

Private student loans

A private student loan is an education loan funded by a private lender, such as a bank, credit union, or online lender.

Great for students who:

- Have a cosigner or good credit score

- Want the ability to apply at any time

- Need more funding than federal loans can provide

TuitionHero tip

While it's generally recommended to begin by exploring federal student loans due to their numerous benefits, it's important to consider additional options, like private student loans, to cover any remaining costs not covered by federal aid.

What can private student loans be used for?

Private student loans can be used to cover any education-related expenses. Some examples of what you should and shouldn’t spend your student loan money on include:

Do’s

Tuition and fees

Housing and utilities

Meals and groceries

A personal computer

Transportation to and from school

Study abroad program

School supplies

Don’ts

Vacation travel

Clothes

Entertainment

Alcohol

Investing

Business expenses

A down payment on a home

How to get a private student loan

Here's how our process works in just three easy steps:

- 1

Enter your school name

First, we'll ask for your school to help improve the accuracy of your loan rates. It's okay to guess with your top pick if you don’t know yet.

- 2

Compare personalized rates from top lenders

Next, we’ll display an organized table with rates and terms from several top lenders. Our table makes it incredibly easy to compare and decide on the best loan for your specific needs.

- 3

Finalize & lock in a great rate

Once you've found a loan you like, we'll help connect you with your chosen lender to complete the application process.

Illustrative purposes, actual results may vary. Prequalified rates are not a firm offer of credit.

Ready to get started?

Let's match you with your perfect student loan.

Students love us

We are honored to have helped hundreds of students find the best loans for their needs. Check out some of our reviews below.

Compare our top lenders and loan interest rates

Unfortunately, we were unable to find any private student loans at this time

What are the best private student loan lenders?

There are loads of student loan options out there, and the best one for you can depend on whether you're looking for a fixed-rate loan, a variable-rate loan, and several other important factors. We've provided you with articles on the best student loan lenders and student loan lender reviews below to make your decision easier.

The best private student loan lenders

See a list of our picks for top private student loan lenders and the areas where they shine the most.

Student loan lender reviews

Read our student loan lender reviews to discover the unique features and benefits of each lender.

Factors to consider when shopping for a private student loan

In order to find the best student loan option with the lowest interest rate and most favorable loan terms, you'll need to consider a variety of important factors while you're shopping. Here are just a few of the most important to look out for.

Eligibility requirements

Private loan lenders typically consider a variety of factors before deciding to make you a loan offer, including your income, credit score, and citizenship status. If you don't meet the minimum loan eligibility requirements, you may need a creditworthy cosigner to increase your chances of approval.

Cosigner release

Speaking of your cosigner, they'll be on the hook to repay your private student loan if you fall behind on repayments. However, lenders typically provide loan terms for cosigner release if you've kept up with your payments for long enough (the exact time period varies lender-by-lender).

Repayment options

You'll want to take into consideration any grace periods, deferment options, or forbearance options your chosen lender may offer in case you experience financial hardships or fall behind on your repayment.

Interest rates

Naturally, the interest rate of the loan is going to be a major factor in your decision-making process, and you’ll come across the terms “fixed interest rates” and “variable interest rates.” Fixed rates remain constant over the life of your loan, while variable rates can increase or decrease with the market. In either case, the lower the interest rate you can secure, the less you'll have to pay back over the life of the loan.

Your private student loan questions answered

An interest rate is a percentage of your loan value that’s added onto your total monthly repayments — this is the cost that comes with borrowing money.

The total amount of interest you owe is determined by the amount of time you take to pay off the loan and your interest rate.

Since more interest is owed with each payment, having less payments by repaying your loan sooner can lead to big savings.

Additionally, getting a low interest rate means that you will owe less interest with each monthly repayment, helping you save money over the life of the loan and pay off your debt faster.

Historically, over 90% of private student loans taken out by undergraduate students are borrowed with a cosigner — a creditworthy individual who agrees to repay the debt if you, as the primary borrower, fall behind. The reason behind this is that students usually haven’t had the time to build up their credit yet to meet lenders’ loan approval requirements.

Even if the lender doesn’t require a cosigner or you don’t need one, applying with a cosigner could improve your chances of qualifying for a private student loan at a lower rate.

While most lenders allow you to borrow up to the total cost of attendance for your school, how much you can actually borrow may vary based on the lender, your major, your credit score, and whether or not you have a cosigner.

A school's total “cost of attendance” is defined by your school and usually includes costs like: tuition and fees, room and board, transportation, school supplies, and any other education-related expenses.

Just because you might be able to borrow 100% of school-related expenses with a private student loan doesn’t mean you should. It’s always a good idea to explore other funding options like federal student loans first before turning to private student loans to cover whatever’s left over.

Each lender has their own requirements for taking out a loan. With that being said, lenders will usually require that you:

Plan to use the loan for education-related expenses

Have a qualifying credit score

Have a qualifying income and debt-to-income ratio (DTI)

Be enrolled in an eligible school

Be a U.S. citizen or legal resident with a Social Security number

If you don't meet the minimum approval requirements, you'll want to apply with a creditworthy cosigner who does in order to qualify. A cosigner is someone who applies with you and agrees to take responsibility for paying back your loan if you don't. A cosigner is usually the student's parent or guardian, but any creditworthy individual can fulfill the role. Even if a cosigner isn't required by the lender, applying with one can increase your chances of approval and help you get a better rate.

Most private student loans will offer you the choice between a fixed- or variable-rate loan. The difference between them is:

A fixed-rate loan has an interest rate that remains the same over the entirety of the loan. This means that your monthly payments won’t change either, leading to predictable payments.

A variable-rate loan has an interest rate that can go up or down with the market. As a result, your monthly payments could increase, but they also have the potential to decrease.

You can still get a private student loan with bad credit, but maybe not on your own. If you have bad credit or no credit at all, you will most likely need to add a cosigner to qualify.

Even if you can get approved for a loan by yourself, your interest rate will likely be high if your credit score is low. One potential way to avoid this and get approved for a student loan with a lower interest rate can be to apply with a creditworthy cosigner.

Generally, the private student loan money is first sent to your school and applied directly towards any tuition and fees you owe. After that, any unused student loan money is usually sent to you through a check or an online deposit.

The exact details of how this process works can vary depending on your particular school and lender, so it’s a good idea to read up on the details or ask ahead of time. For example, your school’s financial aid office can have its own way of redirecting leftover student loan funds. Your lender could also potentially divide the total loan money it gives out across each semester or academic year or simply give out the money all at once.

Student loans can seem stressful and confusing, but just know that you don’t have to tackle it alone. Fortunately, there are many ways to get help without paying for it. You can:

Speak with your high school guidance counselor

Make use of on-campus college resources, such as your financial aid office

Reach out to a federal student loan representative at StudentAid.gov about getting started and application assistance

Contact private student loan companies about their products and services

An interest rate is a percentage of your loan value that’s added onto your total monthly repayments — this is the cost that comes with borrowing money.

The total amount of interest you owe is determined by the amount of time you take to pay off the loan and your interest rate.

Since more interest is owed with each payment, having less payments by repaying your loan sooner can lead to big savings.

Additionally, getting a low interest rate means that you will owe less interest with each monthly repayment, helping you save money over the life of the loan and pay off your debt faster.

Most private student loans will offer you the choice between a fixed- or variable-rate loan. The difference between them is:

A fixed-rate loan has an interest rate that remains the same over the entirety of the loan. This means that your monthly payments won’t change either, leading to predictable payments.

A variable-rate loan has an interest rate that can go up or down with the market. As a result, your monthly payments could increase, but they also have the potential to decrease.

Historically, over 90% of private student loans taken out by undergraduate students are borrowed with a cosigner — a creditworthy individual who agrees to repay the debt if you, as the primary borrower, fall behind. The reason behind this is that students usually haven’t had the time to build up their credit yet to meet lenders’ loan approval requirements.

Even if the lender doesn’t require a cosigner or you don’t need one, applying with a cosigner could improve your chances of qualifying for a private student loan at a lower rate.

You can still get a private student loan with bad credit, but maybe not on your own. If you have bad credit or no credit at all, you will most likely need to add a cosigner to qualify.

Even if you can get approved for a loan by yourself, your interest rate will likely be high if your credit score is low. One potential way to avoid this and get approved for a student loan with a lower interest rate can be to apply with a creditworthy cosigner.

While most lenders allow you to borrow up to the total cost of attendance for your school, how much you can actually borrow may vary based on the lender, your major, your credit score, and whether or not you have a cosigner.

A school's total “cost of attendance” is defined by your school and usually includes costs like: tuition and fees, room and board, transportation, school supplies, and any other education-related expenses.

Just because you might be able to borrow 100% of school-related expenses with a private student loan doesn’t mean you should. It’s always a good idea to explore other funding options like federal student loans first before turning to private student loans to cover whatever’s left over.

Generally, the private student loan money is first sent to your school and applied directly towards any tuition and fees you owe. After that, any unused student loan money is usually sent to you through a check or an online deposit.

The exact details of how this process works can vary depending on your particular school and lender, so it’s a good idea to read up on the details or ask ahead of time. For example, your school’s financial aid office can have its own way of redirecting leftover student loan funds. Your lender could also potentially divide the total loan money it gives out across each semester or academic year or simply give out the money all at once.

Each lender has their own requirements for taking out a loan. With that being said, lenders will usually require that you:

Plan to use the loan for education-related expenses

Have a qualifying credit score

Have a qualifying income and debt-to-income ratio (DTI)

Be enrolled in an eligible school

Be a U.S. citizen or legal resident with a Social Security number

If you don't meet the minimum approval requirements, you'll want to apply with a creditworthy cosigner who does in order to qualify. A cosigner is someone who applies with you and agrees to take responsibility for paying back your loan if you don't. A cosigner is usually the student's parent or guardian, but any creditworthy individual can fulfill the role. Even if a cosigner isn't required by the lender, applying with one can increase your chances of approval and help you get a better rate.

Student loans can seem stressful and confusing, but just know that you don’t have to tackle it alone. Fortunately, there are many ways to get help without paying for it. You can:

Speak with your high school guidance counselor

Make use of on-campus college resources, such as your financial aid office

Reach out to a federal student loan representative at StudentAid.gov about getting started and application assistance

Contact private student loan companies about their products and services

Frequently asked questions

Confused about how things work? Check out our FAQ below for quick answers to all your burning questions.

Absolutely not. You don't need to worry about your credit score at all when you search for personalized rates with us. The only time a hard credit check will occur is when you decide to take your next step by applying for a loan with a specific private lender who will need to determine your ability to make payments.

TuitionHero's private student loan shopping platform is 100% free of charge. There are zero surprise add-ons at the last minute and zero hidden fees.

Tuition Hero receives compensation from the loan provider when you complete a loan application and the loan is disbursed. When it comes to credit cards, the issuer compensates Tuition Hero when you apply for a credit card and are approved. No part of any of these fees fall onto you, and this doesn't affect how the loans and credit cards are displayed on our site.

We are a marketplace, not a loan, bank, or credit card issuer. This allows us to show you offers from multiple competitors side-by-side to help you get the best deal possible on your loans. We make comparison shopping easy by providing you several offers from multiple lenders within minutes. And when lenders compete for your business, it's a win for your wallet!

With so many private student loan options out there, it can be overwhelming! TuitionHero shows you rates and terms from a variety of lenders, so you can compare them side-by-side and easily spot the potential savings.

Shop and compare private student loans — 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.