Advertiser Disclosure

Last update: December 11, 2025

Student loan refinancing basics

TuitionHero has you covered with simple explanations and refinancing options, empowering you to make confident financial decisions.

See My Rates

Compare top lenders

Since 2019, we've helped over 500,000

students make informed decisions about financing their college education.

What is student loan refinancing?

Student loan refinancing is the process of taking out a new loan to pay off your existing student loans. The new loan may have a lower interest rate or better repayment terms, which can save you money on your monthly payments and overall loan costs.

Who is eligible for student loan refinancing?

Student loan refinancing eligibility depends on financial stability and creditworthiness. Lenders typically look for a good credit score, steady income, timely repayment history, and a low debt-to-income ratio. Degree completion may also be required.

When should you refinance a student loan?

A great time to refinance your student loans can be when interest rates have dropped, or your financial situation or credit score has significantly improved, allowing for potentially lower rates. It can also be beneficial if you wish to release a cosigner from the loan.

Can you refinance a student loan more than once?

There's no limit to how many times you can refinance your student loans. It makes sense to refinance again whenever interest rates go down or your financial situation improves. Refinancing is also usually free from fees like prepayment penalties and origination fees.

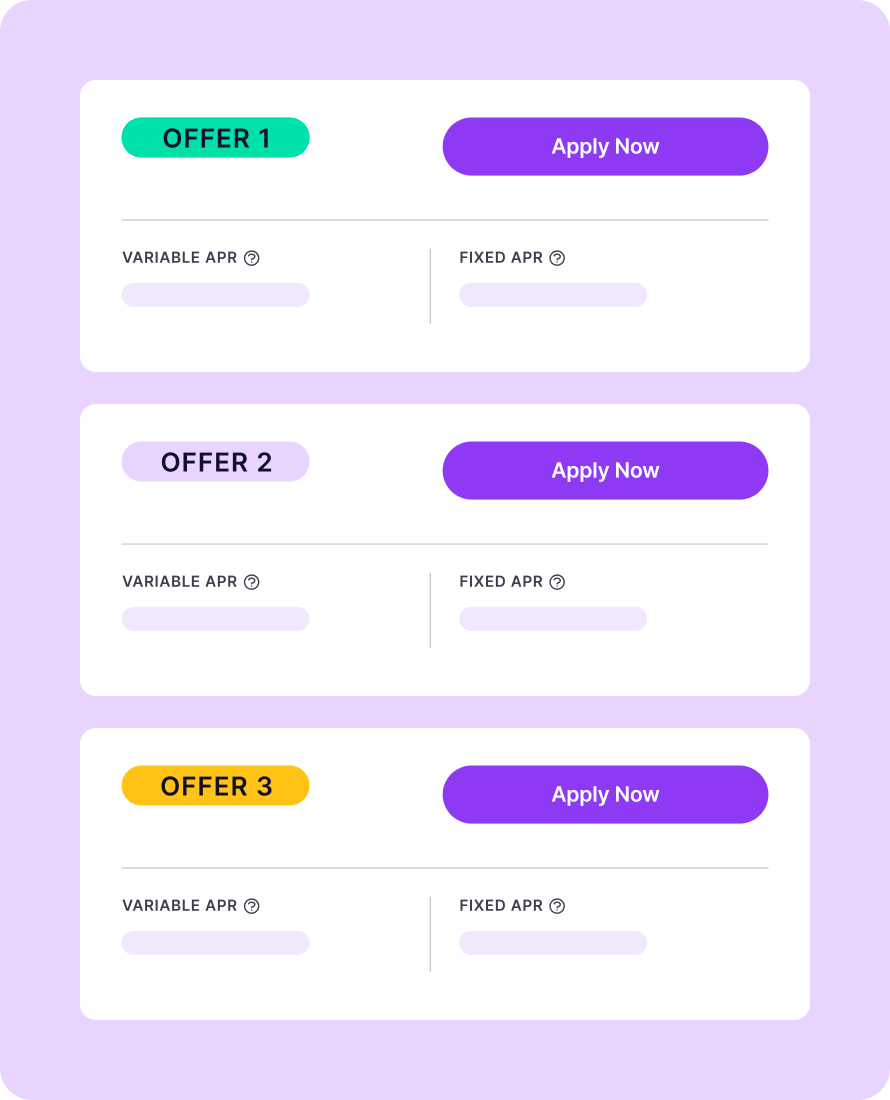

TuitionHero’s best student loan refinancing offers for December 2025

This month, we have a variety of student loan options. We've partnered with top lenders to help make your goals for higher education a reality!

The difference between student loan refinancing and consolidation?

Consolidation and refinancing are the two primary ways to restructure your student loans. Each option has unique characteristics, and they apply to different types of existing loans.

Loan Refinancing

Refinancing replaces an existing loan with a new one, often with better terms or a lower interest rate. This is common when a borrower's credit score improves, or interest rates drop.

Great for students who:

- Have high-interest loans

- Recently improved their credit score

- Want to change their loan term

Loan Consolidation

Consolidation simplifies your loans by combining multiple loans so that there's just one monthly payment to manage. However, loan consolidation usually won't lower your interest rate.

Great for students who:

- Want to manage fewer loan payments

- Want to keep federal loan benefits

- Want to change their loan term

TuitionHero tip

Refinancing makes the most sense whenever interest rates go down or your financial situation improves. That way you have better chances of lowering your interest rate and saving money over the lifetime of your loan.

Do's and don'ts of student loan refinancing

Here are a few things to consider before refinancing your student loans to help you make informed decisions, manage your finances effectively, and avoid unnecessary debt.

Do’s

Consider your ideal monthly payment

Shop around for the best rates and compare multiple lenders

Make sure you have a strong credit score or cosigner before applying

Double-check that your lender has your current contact information

Don’ts

Settle on the first lender you see

Give personal or financial information to unfamiliar callers

Choose a loan with a higher interest rate than you had before

Refinance federal loans without considering the loss of federal benefits

How to refinance your student loans

Here's how our process works in just three easy steps:

- 1

Research and compare lenders

Give us some basic details, and we'll show you some loan rate estimates. TuitionHero can show you rates in just a few minutes, without affecting your credit score. Don't just look at rates though. Be sure to consider the whole package, like repayment protections and fees.

- 2

Gather necessary information

Before you apply, gather essential details and documents such as your Social Security number, proof of income, tax returns, and specifics about your school and program. If you're adding a cosigner, make sure to get their info as well.

- 3

Wait for loan approval

After submitting your documents and application, you'll need to wait for the lender to review and approve it. This can take anywhere from a few days to a few weeks, depending on the lender and the type of loan. Remember to be patient and stay in contact with your lender.

- 4

Review and sign

Once your loan is approved, carefully review the terms and conditions, including the interest rate, fees, and repayment options. This includes the repayment schedule, interest rates, penalties for late or missed payments, and any other relevant terms. Make sure you know your responsibilities as a borrower before accepting the loan.

Illustrative purposes, actual results may vary. Prequalified rates are not a firm offer of credit.

Ready to get started?

Let's match you with your perfect refinancing option.

Compare our top lenders and refinance interest rates

Unfortunately, we were unable to find any student loan refinance offers at this time

What are the best student loan refinancing lenders?

There are many different refinancing choices available, and the right one for you depends on whether you want a lower interest rate or a lower monthly payment, along with other important factors to consider. We've provided you with articles on the best student loan lenders and student loan lender reviews below to help make your decision easier.

The best student loan refinance lenders

See a list of our picks for top student loan refinancing lenders and the areas where they shine the most.

Student loan lender reviews

Read our student loan lender reviews to discover the unique features and benefits of each lender.

Factors to consider when refinancing a student loan

In order to find the best student loan refinancing options with the lowest interest rate and most favorable loan terms, you'll need to consider a variety of important factors while you're shopping. Here are just a few of the most important to look out for.

Interest rates

You should compare the interest rates of different lenders to find the best deal, ideally lower than what you're currently paying.

Hardship options

Some lenders may offer benefits such as temporarily delaying or reducing payments in case you experience financial hardships or fall behind on your repayment. You can learn more about these options in our comparison table below.

The loan term

The term of the loan will affect the monthly payment amount. A longer-term loan will result in a lower monthly payment, but you will end up paying more in interest over the life of the loan.

Cosigner release

If you have a cosigner on your existing student loan who no longer wishes to be attached to it, you should look for a lender with an option to remove your cosigner.

Your student loan refinancing questions answered

While the exact requirements vary by lender, you typically need to have:

- A degree: You should be able to find a lender willing to refinance your student loans if you have a degree from an accredited university

- A good credit score: A strong credit score will likely allow you to get a lower interest rate, which will save you money over the life of your loan

- A steady income: You'll probably qualify for a lower monthly payment with a stable income, which will make it easier to afford your loan payments

Your credit score is one of the key factors that lenders look at when considering your application for a refinance loan. A higher credit score indicates to lenders that you're a lower-risk borrower, which could lead to a lower interest rate on your loan. Generally, you'll need a credit score of at least 650 to qualify for student loan refinancing.

There are a few options available to those looking to refinance their student loans with bad credit.

The fastest and simplest option is to apply with a cosigner who has good credit. This can increase your chances of getting approved for a lower interest rate.

Another option is to work on building your own credit by setting reminders and budgeting so that you can consistently pay bills on time. Lenders also consider how much money you're borrowing relative to how much you're making. If you can find a way to earn more, then you'll be more likely to qualify.

Student loan consolidation and refinancing are similar, but they're used in slightly different situations:

- Consolidation is best for federal loans. It combines one or more federal loans into a new federal loan to let you make a single payment and qualify for government programs. Private student loans are not eligible for consolidation.

- Refinancing is best for saving money. It gathers one or more existing federal or private loans into a new private student loan, ideally with a lower interest rate that will help you pay less over time.

Most student loans will offer you the choice between a fixed- or variable-rate loan. The difference between them is:

- A fixed-rate loan has an interest rate that remains the same over the entirety of the loan. This means that your monthly payments won’t change either, leading to predictable payments.

- A variable-rate loan has an interest rate that can go up or down with the market. As a result, your monthly payments could increase, but they also have the potential to decrease.

When you refinance, there will be a hard credit inquiry the moment you apply for the new loan. A hard inquiry is when a lender looks into your credit history to make a loan approval decision. The good news is that any hard inquiry will have only a small and temporary impact on your credit score. Typically your score will drop by five points or less, and it will affect your credit report for two years at most.

There's no limit on how many times you can refinance your student loans. Not only that, but it can make a lot of sense to refinance multiple times, especially whenever interest rates go down or your financial situation improves. Refinancing is also usually free from fees like prepayment penalties and origination fees, so refinance away!

Whether you should consolidate or refinance depends on the kind of loan that you have.

- When to consolidate: If you have one or more federal loans, you may want to consolidate those loans so that you can make a single payment and still maintain your federal loan benefits. There is no option to consolidate private student loans.

- When to refinance: If you have one or more private student loans, you'll want to refinance any time your financial situation improves or interest rates go down so that you save money. While you could refinance your federal loans to get a lower rate, it would mean losing your federal loan benefits, so there's a trade-off.

While the exact requirements vary by lender, you typically need to have:

- A degree: You should be able to find a lender willing to refinance your student loans if you have a degree from an accredited university

- A good credit score: A strong credit score will likely allow you to get a lower interest rate, which will save you money over the life of your loan

- A steady income: You'll probably qualify for a lower monthly payment with a stable income, which will make it easier to afford your loan payments

Most student loans will offer you the choice between a fixed- or variable-rate loan. The difference between them is:

- A fixed-rate loan has an interest rate that remains the same over the entirety of the loan. This means that your monthly payments won’t change either, leading to predictable payments.

- A variable-rate loan has an interest rate that can go up or down with the market. As a result, your monthly payments could increase, but they also have the potential to decrease.

Your credit score is one of the key factors that lenders look at when considering your application for a refinance loan. A higher credit score indicates to lenders that you're a lower-risk borrower, which could lead to a lower interest rate on your loan. Generally, you'll need a credit score of at least 650 to qualify for student loan refinancing.

When you refinance, there will be a hard credit inquiry the moment you apply for the new loan. A hard inquiry is when a lender looks into your credit history to make a loan approval decision. The good news is that any hard inquiry will have only a small and temporary impact on your credit score. Typically your score will drop by five points or less, and it will affect your credit report for two years at most.

There are a few options available to those looking to refinance their student loans with bad credit.

The fastest and simplest option is to apply with a cosigner who has good credit. This can increase your chances of getting approved for a lower interest rate.

Another option is to work on building your own credit by setting reminders and budgeting so that you can consistently pay bills on time. Lenders also consider how much money you're borrowing relative to how much you're making. If you can find a way to earn more, then you'll be more likely to qualify.

There's no limit on how many times you can refinance your student loans. Not only that, but it can make a lot of sense to refinance multiple times, especially whenever interest rates go down or your financial situation improves. Refinancing is also usually free from fees like prepayment penalties and origination fees, so refinance away!

Student loan consolidation and refinancing are similar, but they're used in slightly different situations:

- Consolidation is best for federal loans. It combines one or more federal loans into a new federal loan to let you make a single payment and qualify for government programs. Private student loans are not eligible for consolidation.

- Refinancing is best for saving money. It gathers one or more existing federal or private loans into a new private student loan, ideally with a lower interest rate that will help you pay less over time.

Whether you should consolidate or refinance depends on the kind of loan that you have.

- When to consolidate: If you have one or more federal loans, you may want to consolidate those loans so that you can make a single payment and still maintain your federal loan benefits. There is no option to consolidate private student loans.

- When to refinance: If you have one or more private student loans, you'll want to refinance any time your financial situation improves or interest rates go down so that you save money. While you could refinance your federal loans to get a lower rate, it would mean losing your federal loan benefits, so there's a trade-off.

Frequently asked questions

Confused about how things work? Check out our FAQ below for quick answers to all your burning questions.

Absolutely not. You don't need to worry about your credit score at all when you search for personalized rates with us. The only time a hard credit check will occur is when you decide to take your next step by applying for a loan with a specific private lender who will need to determine your ability to make payments.

TuitionHero's private student loan shopping platform is 100% free of charge. There are zero surprise add-ons at the last minute and zero hidden fees.

Tuition Hero receives compensation from the loan provider when you complete a loan application and the loan is disbursed. When it comes to credit cards, the issuer compensates Tuition Hero when you apply for a credit card and are approved. No part of any of these fees fall onto you, and this may affect how the loans and credit cards are displayed on our site.

We are a marketplace, not a loan, bank, or credit card issuer. This allows us to show you offers from multiple competitors side-by-side to help you get the best deal possible on your loans. We make comparison shopping easy by providing you several offers from multiple lenders within minutes. And when lenders compete for your business, it's a win for your wallet!

With so many private student loan options out there, it can be overwhelming! TuitionHero shows you rates and terms from a variety of lenders, so you can compare them side-by-side and easily spot the potential savings.

Shop and compare student loan refinancing lenders - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find a student loan refinancing lender today

Compare Personalized Rates