Advertiser Disclosure

Credit cards, made simple

Select a category to start comparing top offers. See offers side-by-side and learn more about interest, points, and rewards.

What Are Credit Cards?

A credit card is a revolving line of credit issued by a bank or financial institution that lets you make purchases up to a pre-approved limit. Each billing cycle, you receive a statement showing your balance and the minimum payment due.

Key features include:

- Credit limit: Maximum you can charge.

- APR (Annual Percentage Rate): Interest rate if you carry a balance.

- Rewards: Cash back, points, or miles earned on purchases.

- Fees: Possible annual, late-payment, balance-transfer, or foreign-transaction fees.

- Grace period: Time to pay your balance in full without incurring interest.

Students may also choose a specialized education credit card offering tailored perks like bonus points on textbooks or meal plans.

TuitionHero’s best credit cards for December 2025

This month, we have a variety of student loan options. We've partnered with top lenders to help you find the perfect card for lower interest rates, travel rewards, cash back, and more!

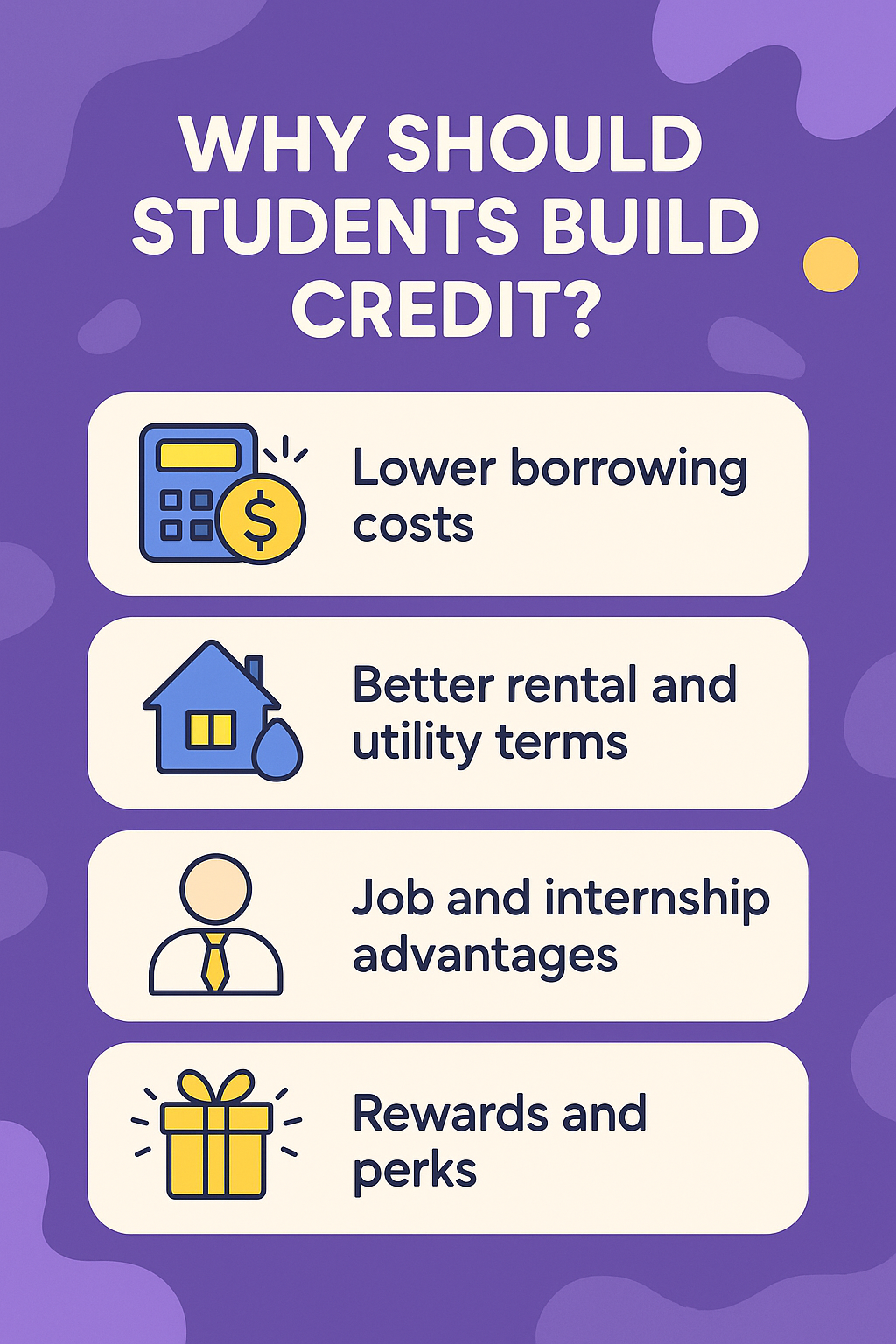

Why should you build credit?

Building a strong credit profile in college sets you up for savings and opportunities later:

- Lower borrowing costs: Good credit unlocks lower interest rates on auto loans, mortgages, and personal lines of credit.

- Better rental and utility terms: Landlords and utility providers often check your score—strong credit can eliminate hefty security deposits.

- Job and internship advantages: Certain employers and internship programs screen credit reports as part of their vetting.

- Rewards and perks: Access to premium card sign-up bonuses, travel perks, and exclusive student offers.

Who should apply for a student credit card?

If you’re at least 18 and can show sufficient income—either independently or via a co-signer if you’re under 21—and you’re prepared to track spending, pay in full each month, and keep balances low, you’re a good candidate for a student credit card.

If you lack any credit history, consider first becoming an authorized user on someone else’s account or opening a secured card to build your profile. Then explore the best student credit cards 2025 to see current top offers.

Can you pay tuition with a credit card?

Most colleges now let you pay tuition by credit card, but policies and fees vary: some schools forbid it entirely, a few (notably several SUNY campuses) allow fee-free swipes, and many impose a 2–3% “convenience” surcharge.

To find your school’s rules, check your bursar’s website, Google “[Your College] tuition credit card fee,” or call the finance office. Then compare your card’s rewards rate against any fee to decide if it’s worth it.

To find the best credit card for tuition, ensure the rewards you earn outstrip any fees, and hunt for credit card offers for education that can minimize those surcharges. If you’re focused on the best credit card for education expenses, this evaluation helps maximize your return.

How to compare student credit cards

When comparing credit cards for students, start by mapping your spending to card features: annual fees, intro APR, and rewards structure. Use tools to compare credit cards rewards side by side.

Be sure to compare college credit cards across issuers, and aim to choose the best credit card to pay tuition based on your needs.

- Annual fee: Ideally, $0 will be charged to keep costs low and maintain the account long-term.

- Sign-up bonus: Ensure the required spend is realistic and that the bonus outweighs any fees.

- Rewards structure: Flat cash-back vs. category bonuses vs. transferable points—choose what matches your spending.

- Introductory APR offers: 0% APR on purchases can let you pay off a large expense interest-free.

- Foreign transaction fees: 0% if you study abroad or travel internationally.

- Credit reporting: Must report to Equifax, Experian, and TransUnion.

- Upgrade path: Issuers that allow product changes to stronger cards without a new application.

How to get a credit card

Applying for a credit card using TuitionHero is easy.

- 1

Decide why you want a credit card

Do you want a credit card for cash back? Travel? What about credit building? Understanding your motivation helps you focus on the cards that meet your needs and interests.

- 2

Check your credit score

Your credit score helps determine whether you get approved, and each card issuer has different requirements. Luckily, there are plenty of online resources that can inform you of your credit score.

- 3

Compare credit card offers

Once you've found a loan you like, we'll help connect you with your chosen lender to complete the application process.

- 4

Apply for the best credit card for you

Once you’ve decided on a card, simply click 'Apply Now' to finish your application on the card issuer website. You can expect to get your approval decision (and hopefully new credit card) soon after.

Illustrative purposes, actual results may vary. Prequalified rates are not a firm offer of credit.

Ready to get started?

Let’s match you with your perfect credit card.

Find the right card for you

TuitionHero makes it simple to find the ideal credit card. We show you cards with top rewards like cash back, travel benefits, and low interest. We've done the research to make your card selection effortless.

CATEGORY | EDITOR TOP PICK | |

|---|---|---|

Rewards | Capital One Venture Rewards Credit Card | View all Rewards cards |

Top Student | My GM Rewards Card™ | View all Top Student cards |

Our student credit card reviews

Our experts at TuitionHero did the research so you don’t have to! Check out our reviews below if you're interested in an in-depth look at some of our most popular credit cards this month.

Frequently asked questions

Confused about how things work? Check out our FAQ below for quick answers to all your burning questions.

Paying tuition with a credit card can be worthwhile—but only if the value you earn in rewards or meet a sign-up bonus outweighs any convenience fee (typically 2–3%) and you pay your balance in full before interest kicks in.

For example, if your card earns 3% back and your school charges a 2.5% fee, you net a 0.5% gain on a large payment—and you also benefit from any welcome-offer spend.

Always confirm your school treats tuition as a purchase (not a cash advance), do the math beforehand, and ensure you have the cash flow to avoid carrying a balance at a high APR.

Yes—if you’re ready to use it responsibly. A student credit card can help you build or strengthen your credit history, unlock low-fee borrowing options later, and earn perks like cash back or travel points.

To make it work in your favor, choose a $0-annual-fee card, pay in full each month, keep your utilization under 30%, and monitor your score. If you lack existing credit, start as an authorized user or with a secured card until you qualify for an unsecured student card.

Before you pay, contact your card issuer to confirm that the college’s merchant category code (MCC) is coded as an education expense and not a cash advance.

You can also call your bursar’s office to verify they accept credit cards under the standard purchase MCC. If treated as a purchase, you’ll earn rewards and avoid cash-advance fees and immediate interest.

Yes—many schools let you make multiple transactions for one bill. Splitting your payment lets you hit welcome-bonus thresholds or earn category bonuses on different cards. Just confirm with your bursar’s office that they allow partial payments by card and be mindful of multiple convenience fees.

Most tuition payments post like any other purchase, taking 1–3 business days to appear on your account. Rewards may only post when the payment fully settles, which can be another 1–2 days.

Check your issuer’s rewards policy to understand exact timing and ensure you meet any minimum-spend windows for sign-up bonuses.

Finished scrolling? Start browsing credit cards that work for you

Select your preferred card category and start comparing your options.