Advertiser Disclosure

Last update: June 11, 2025

9 minutes read

What is a Credit Card Cash Advance? Fees, Risks, and Options

Wondering if a cash advance is bad for your finances? Discover how high APRs and fees hike your costs, why cash advances can hurt your credit, and explore lower-cost options.

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

Accessing emergency cash via a credit card cash advance can seem quick, but often comes with high costs. In this guide, we’ll explain what is a cash advance and explore lesser-known options beyond your typical ATM withdrawal.

You’ll learn what is a cash advance on a credit card and other advance vehicles so you can compare true APRs and fees. Armed with this info, you’ll pick the smartest way to bridge short-term money needs.

Key takeaways

- Cash advances allow you to withdraw money against your credit card limit

- They should be used only in emergencies due to high fees and APRs

- Cash advances can impact your credit score by affecting your credit utilization rate

What is a cash advance?

What is a cash advance? A cash advance is when you withdraw money at the ATM against your credit card limit.

Think of it like using your credit card to "buy" cash rather than goods or services. It sounds straightforward, but this move can cost more than you might expect. Cash advances can also include using credit card convenience checks or transferring funds from your credit card to your bank account.

How do cash advances work?

You might think, "Hey, it's just like taking out cash with my debit card, right?" Well, not really.

A cash advance is like a mini loan from your credit card. You're borrowing against your credit limit. And while that sounds simple enough, the process and the costs involved are where things get tricky.

You can usually take out from $100 to up to 30% of your credit limit. But here's the kicker: your credit card usually charges an additional fee to do a cash advance. Additionally, the cash advance limit is often lower than your total credit limit, so you may not have access to the full amount you expect.]

TuitionHero Tip

So, if you're thinking of pulling out a cool $1,000 and your fee is 3%, you'll have to pay your credit card an extra $30 on top of the $1,000 you need to repay. I'll let that sink in.

What's the real cost of a cash advance?

Let's break it down:

- Cash advance fee: This is either a fixed amount, say $10, or a percentage of the cash advance, which can be anywhere from 3%-6%. This is paid straight to your credit card company. So if your card has a limit of $5,000, and you think you're smartly taking out $1,500, you actually might owe back $1,600, depending on the rate.

- ATM or bank fees: Used a different bank's ATM? More fees. Did you take the advance from a bank in person? They might charge for that luxury, too.

- Higher APR: The interest rate on cash advances can be higher than your card's usual rate. And interest starts piling on immediately. No grace period. Insane, right? For example, while your regular purchase APR might be 15%, the cash advance rate on a credit card could be 25% or higher.

What's the impact on my credit?

Now, let's dive into a topic many tend to overlook: your credit score. You might be thinking, "How bad can it be, right?" Well, let's take a look.

Credit utilization

Every time you use your card, you're using a portion of your credit. Cash advances take up a chunk of this.

So, if you're maxing out or taking a big amount, you're increasing your credit utilization rate. Financial gurus always advise keeping this rate below 30%.

So, if you've got a credit limit of $5,000, you really don't want to be using more than $1,500 at any given time. And with cash advances, it's easy to forget this golden rule.

While cash advances themselves aren't specifically reported to credit bureaus, the increased balance can raise your credit utilization ratio, which can lower your credit score.

Credit score

If you're not careful, cash advances can start a domino effect. High utilization can affect your credit score.

A lower score can affect future loan approvals, interest rates, your ability to rent, and even job opportunities (yeah, some employers check credit scores!). So, while that quick cash might solve today's problem, it could introduce a bunch of new ones tomorrow.

Additionally, relying on cash advances might signal financial distress to lenders, potentially affecting your ability to get new credit.

Is a cash advance bad for your credit? Generally, yes, because it can increase your debt and affect your credit utilization ratio.

Are cash advances ever a solid choice?

I'm not a big fan of them. They're expensive. But sometimes, they might be the lesser evil. However, if you're diving into this, do it with your eyes wide open:

- Pay it off ASAP: Interest starts kicking in from day one. You don't want that counter running for long.

- Limit the amount: Only take out what you really need.

- Explore other options first: Consider negotiating a payment plan with creditors or exploring other emergency funding options before opting for a cash advance.

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

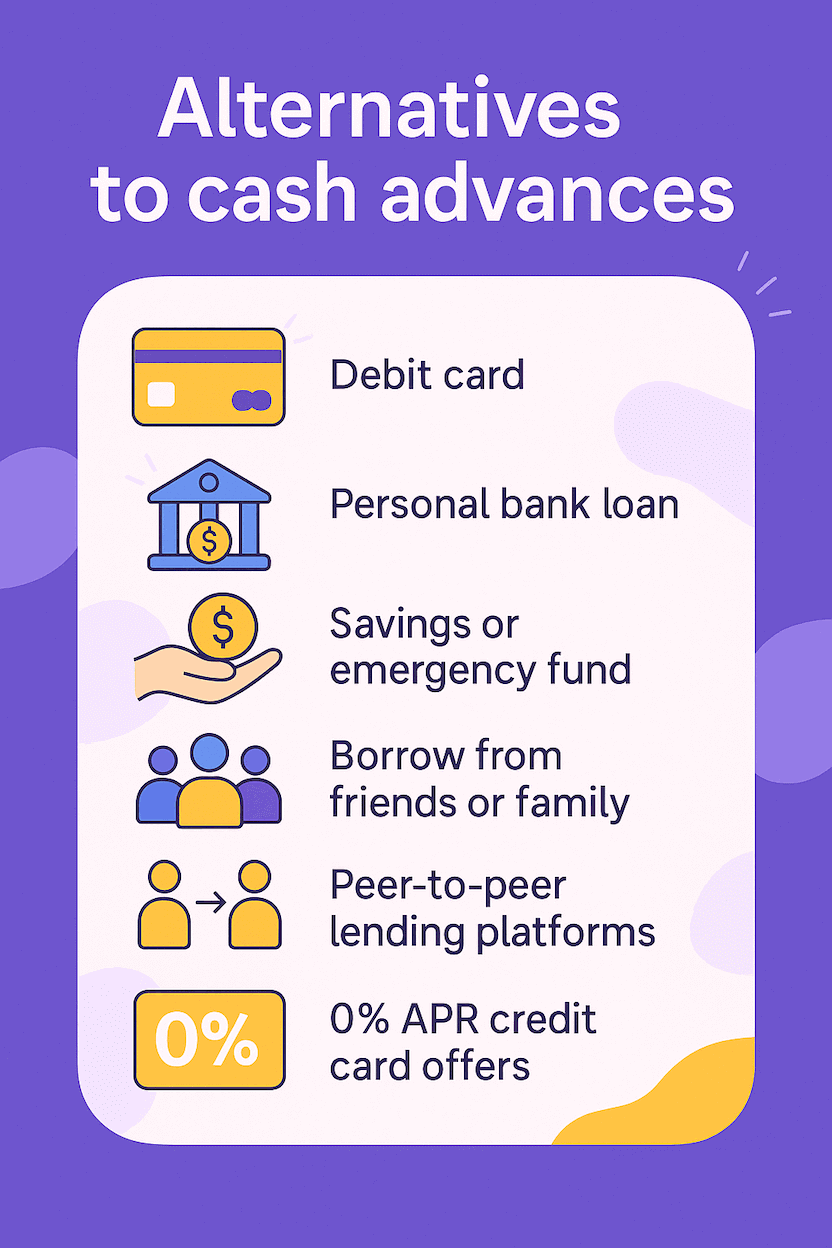

Looking for alternatives to cash advances?

We've all been there, low on cash and looking for a quick fix. But before you jump onto the cash advance train, here are some alternatives you might want to consider:

- Debit card: Use it to access funds from your checking or savings.

- Personal bank loan: This might be a better option with lower interest rates.

- Savings or emergency fund: If you've been smart and kept one, now might be the time to dip in.

- Borrow from friends or family: A bit old school, but hey, sometimes it's the best option. Just remember, always pay it back. Nobody likes that person who "forgets".

- Peer-to-peer lending platforms: These can offer lower rates than cash advances.

- Credit counseling services: They can help you manage your finances and find better solutions.

- 0% APR credit card offers: If you qualify, transferring a balance to a card with a 0% introductory rate could be a better option.

Types of cash advances beyond credit cards

App-based cash advances

Some apps offer advances of $100–$1,000 against your next paycheck with no credit check—so you don’t need a cash advance credit card to tap your credit line.

Although there’s no upfront fee, ask about any optional tips—these effectively function as a cash advance fee and can push your cost higher than you think.

Merchant cash advances (MCAs)

MCAs are designed for small businesses that need quick capital in exchange for a percentage of future card receipts. If you’ve ever wondered "What is cash advance APR?", itemize the factor rate annualized—it often soars above 50% for MCAs.

There’s no fixed term—lenders collect a daily or weekly “holdback” directly from your sales until the advance is repaid. Before comparing, remember that a cash advance on credit card works differently, with its own set of APRs and fees.

Payday loans vs. payday alternative loans (PALs)

Payday loans provide up to $500 against your next paycheck but can carry APRs above 400%, and many states cap or ban them outright. If you’re weighing how to get a cash advance from a credit card, remember credit cards bypass state usury limits, yet still come with steep costs.

PALs, offered by some credit unions, cap loans at $200–$1,000 repaid over several months with APRs usually under 28%. If you’ve tried how to get a cash advance on a credit card only to face high APRs, PALs let you borrow more affordably with clearer terms.

Dos and don'ts of using cash advances

Before you go charging into the world of cash advances, here's a quick set of some do’s and don'ts to keep in mind:

Do

Pay off the balance ASAP

Limit the amount you withdraw

Check other financial alternatives

Don't

Forget about the fees

Use it as a regular ATM

Neglect the impact on your credit score

How can you get a cash advance?

- At an ATM: Like your regular cash withdrawal, but you'll use your credit card and its PIN. If you're scratching your head, thinking, "What PIN?", you can often get it from your card issuer online.

- At your bank: Just show up, show your ID, and you're good to go.

- Over the phone: Some credit card companies let you call them up and have the cash transferred to a bank account. Handy, but not all companies offer this.

- Using convenience checks: Some credit card companies provide checks that can be used like personal checks, and the amount is added to your credit card balance as a cash advance.

Advantages and disadvantages of using cash advances

Navigating the world of finance can be a challenge, especially when learning about cash advances. Here, we'll lay down the benefits and pitfalls, giving you a clearer view of this option.

- Immediate access to funds: Perfect for emergencies when you need cash right now.

- Available worldwide: Most ATMs globally will provide a cash advance, so you're not limited by location.

- No approval process: Unlike traditional loans, there's no waiting period or approval. If you have the credit, you can access the cash.

- Option for those without a bank: For people without a traditional bank account, it provides a way to get cash.

- High interest rates: Often, the APR for cash advances is a lot higher than standard rates.

- Immediate interest: Interest starts accruing from day one, unlike standard credit card purchases which might have a grace period.

- Fees galore: From cash advance fees to potential ATM fees, the costs can stack up.

- Potential credit score impact: High credit utilization from a cash advance can negatively affect your credit score.

Federal judge rules cash advances are “credit” under ECOA

In March 2025, a federal court held that cash advances must be treated as “credit” under the Equal Credit Opportunity Act, meaning issuers now face strict anti-discrimination obligations and disclosure requirements when offering advances.

Lenders extending advances—whether to consumers or small businesses—must also report activity under Section 1071 of Dodd-Frank, boosting transparency on advance transactions.

Why trust TuitionHero

We help students and parents with services like Private Student Loans, Student Loan Refinancing, and FAFSA Assistance. We also offer guidance on scholarships and great Credit Card Offers tailored for students. TuitionHero is here to support smart financial decisions for a brighter future.

Frequently asked questions (FAQ)

A credit card cash advance involves withdrawing cash from your credit card, while a regular purchase involves buying goods or services directly with your card. Cash advances often have higher fees, interest rates, and may not have a grace period like regular purchases.

While it's technically possible to use a credit card cash advance to pay off other debts, it's generally not advisable due to the high fees and interest rates associated with cash advances. It's often more financially beneficial to explore other debt consolidation options.

Yes, there are alternative options like personal loans, borrowing from friends or family, or establishing an emergency fund that might have lower fees and interest rates compared to credit card cash advances.

Yes, the terms and conditions for credit card cash advances, including fees, interest rates, and limits, vary among credit card issuers. It's essential to review your card's specific terms before considering a cash advance.

A cash advance itself isn’t reported differently than a regular balance, but it can hurt your credit score indirectly. Since cash advances start accruing interest immediately and often carry high APRs, your balance can grow quickly.

A higher balance raises your credit utilization ratio, which is a key factor in credit scoring models. Keeping that ratio below 30% is ideal—any sudden spike from a large cash advance can ding your score until you pay it down.

Cash advances come with steep costs and immediate interest. You’ll pay both a cash advance fee (often 3–6% of the amount) and a higher APR—sometimes 20–30% or more—with no grace period.

That combination means every day your advance remains unpaid, you’re losing money. In nearly all cases, cheaper alternatives—personal loans, borrowing from friends or family, or tapping an emergency fund—are the smarter choice.

Final thoughts

Understanding the full landscape of cash advances can save you from costly surprises. Whether you’re weighing an app advance, MCA, or payday loan, always calculate the APR and read the fine print.

Building an emergency fund or exploring lower-cost alternatives is almost always the better strategy. Remember that credit card cash advances are just one option among many, and often not the cheapest.

Sources

Author

Brian Flaherty

Brian is a graduate of the University of Virginia where he earned a B.A. in Economics. After graduation, Brian spent four years working at a wealth management firm advising high-net-worth investors and institutions. During his time there, he passed the rigorous Series 65 exam and rose to a high-level strategy position.

Editor

Rachel Lauren

Rachel Lauren is the co-founder and COO of Debbie, a tech startup that offers an app to help people pay off their credit card debt for good through rewards and behavioral psychology. She was previously a venture capital investor at BDMI, as well as an equity research analyst at Credit Suisse.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today

Compare Personalized Rates