Advertiser Disclosure

Last update: June 6, 2025

13 minutes read

Income-Based Repayment (IBR) Plan Explained

Curious about the IBR plan for student loans? Learn how income-based repayment works, who qualifies, how to calculate payments, and what benefits, like forgiveness, to expect.

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

Struggling to keep up with your student loan payments? The IBR plan adjusts your monthly payments based on your income and family size, offering much-needed flexibility when money’s tight. If you have federal student loans and are exploring ways to lower your payments or avoid default, student loan IBR may be your best next step.

We’ll break down what does income based repayment mean, who qualifies, and what benefits—and potential drawbacks—to expect. You’ll also see a real-world example that shows how much you could save each month.

Key takeaways

- Income-Based Repayment (IBR) caps your payments based on discretionary income

- You must recertify your income and family size annually to stay in the IBR program

- Public Service Loan Forgiveness (PSLF) can significantly reduce your repayment duration for qualifying borrowers

What is an Income-Based Repayment (IBR) plan?

An Income-Based Repayment (IBR) plan caps your monthly student loan payments at a certain percentage of your discretionary income. This can make repaying your student loans more manageable if your income is lower relative to your debt.

The IBR plan is one of four Income-Driven Repayment (IDR) plans that the Department of Education offers for federal student loans. Currently, it is one of just two IDR plans open to new enrollees.

How does the IBR plan determine my payment amount?

The IBR plan bases your monthly payment on your discretionary income. If you borrowed on or after July 1, 2014, your payments are capped at 10% of your discretionary income. For loans borrowed before this date, the cap is 15%.

What is discretionary income?

Discretionary income under the IBR plan is calculated by taking your adjusted gross income (AGI) before taxes and subtracting 150% of the poverty guideline for your family size and state of residence. This means your monthly payments are tailored to your income and living circumstances.

TuitionHero Tip

Under other IDR plans, discretionary income can be calculated differently - so always make sure you double-check the fine print and know exactly how much you’ll be paying when you sign up for a repayment plan.

How does IBR compare to other IDR plans?

IBR is a type of income-driven repayment plan (IDR). IDR is an umbrella term that covers all of the different plans that take into account income when determining payments.

- Pay As You Earn (PAYE) Plan: Caps payments at 10% of discretionary income for newer loans. Any remaining loan balance after 20 years is forgiven. Not currently accepting new enrollments.

- Saving on A Valuable Education (SAVE) Plan: Caps payments at 5% of discretionary income for undergraduate borrowers. Any remaining loan balance after 20 years for undergrad loans is forgiven. Formerly called the REPAYE plan.

- Income-Contingent Repayment (ICR) Plan: Caps payments at the lesser of 20% of discretionary income or what you would pay over 12 years on a fixed plan. Not currently accepting new enrollments (with limited exceptions).

What is a partial financial hardship?

To qualify for an IBR student loan plan, you must demonstrate what's called a partial financial hardship. This happens when the monthly amount you'd pay under a Standard (10-Year) Repayment Plan is more than what you'd pay under IBR based on your income and family size.

Even if your income increases in the future and you no longer meet the hardship requirement, you can remain on the IBR repayment plan.

However, your monthly payment will shift from being income-based to a fixed amount—but it will never exceed what you would have paid under the Standard Plan when you first joined IBR. This built-in cap provides a safety net as your income grows.

Eligibility for IBR

- You must have a federal student loan.

- If you borrowed on or after July 1, 2014, your plan would cap payments at 10% of discretionary income.

- If you borrowed before July 1, 2014, your plan would cap payments at 15% of discretionary income.

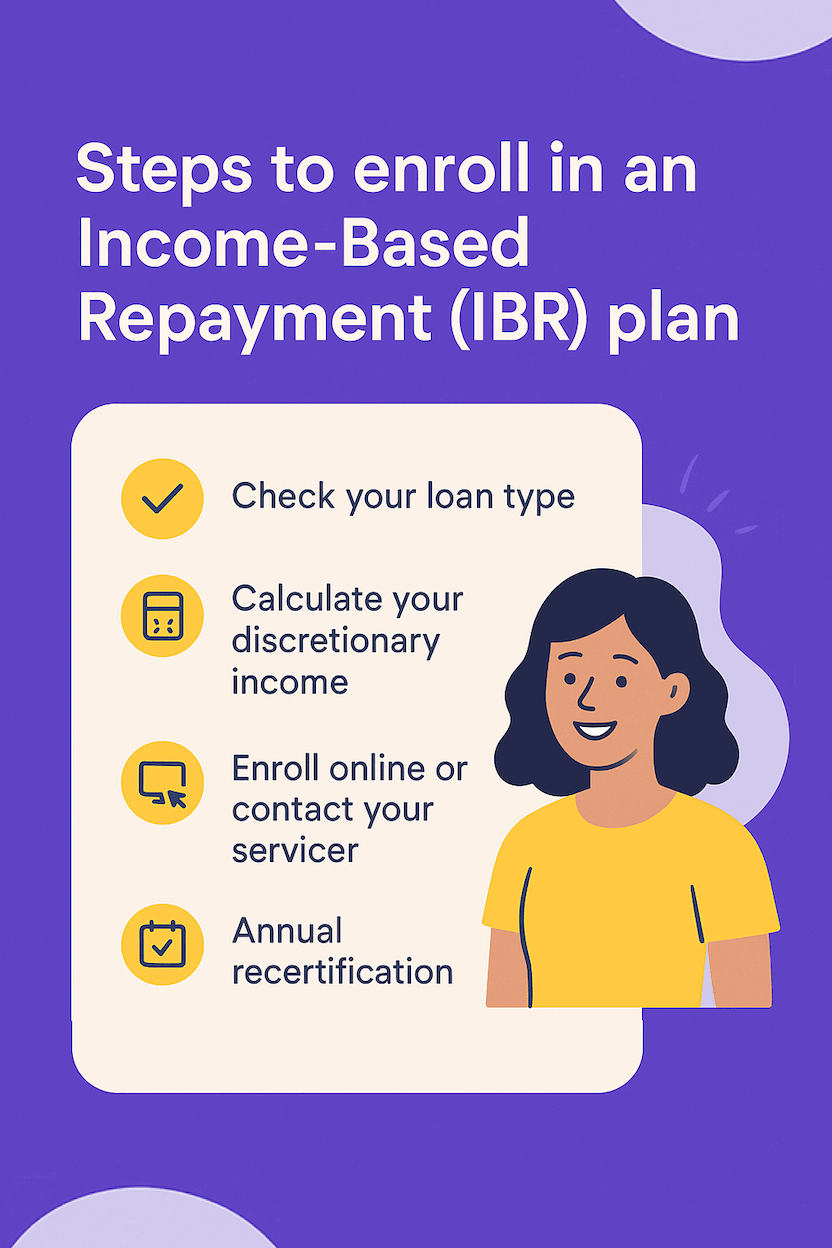

Steps to enroll in an IBR plan

- Check your loan type: Ensure you have a direct loan that qualifies for IBR.

- Calculate your discretionary income: Use the U.S. Department of Education's Loan Simulator to estimate your payments.

- Enroll online or contact your servicer: Some borrowers may need to enroll online, while others with older loans might need to contact their loan servicers directly. Either way, search your loan servicer’s requirements

- Annual recertification: Update your income and family size each year to stay in the IBR plan.

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

How does IBR benefit borrowers?

- Lower monthly payments: Tailored payments based on your income make it easier to manage your budget.

- Still open for enrollment: The IBR plan is one of just two IDR plans still open for enrollment.

- Loan forgiveness: Remaining balances are forgiven after 20 or 25 years, depending on when you took out your loan.

Drawbacks of IBR

- Longer repayment period: It can extend your loan term up to 25 years, meaning you’ll pay interest longer. This might also mean you end up paying more in interest.

- Interest may accrue: Monthly payments might not cover interest, causing your balance to grow over time. However, because the remaining balance is forgiven after 20 or 25 years of payments, this is not relevant unless you plan to pay down with large lump sums.

- Annual paperwork: Annual recertification adds an extra layer of administrative work.

How do I qualify for an income-driven repayment plan?

To be eligible for any income-driven repayment (IDR) plan, including IBR, you need a federal student loan. Direct Loans and Direct PLUS Loans are immediately eligible for IDR plans, although Federal Family Education Loans (FFEL) might need to be consolidated into a direct loan first.

For example, the Pay As You Earn (PAYE) plan requires that you’ve borrowed your first federal loan after October 1, 2007, and that you’ve borrowed a Direct Loan or a Direct Consolidation Loan after October 1, 2011.

TuitionHero Tip

Always confirm the specifics of your loans through the U.S. Department of Education's Loan Simulator.

IBR payment example: how it’s calculated

Understanding how your IBR loan payment is calculated can make the plan feel much more approachable. Here's a simplified example using a borrower with a $35,000 annual income and a family size of 1.

Step 1: Find your discretionary income

Discretionary income is your adjusted gross income (AGI) minus 150% of the federal poverty guideline for your family size and state. For a single person in most states, the 2024 poverty guideline is approximately $14,580. Multiply that by 1.5:

- $14,580 × 1.5 = $21,870 (150% of poverty guideline)

- $35,000 – $21,870 = $13,130 discretionary income

Step 2: Calculate monthly IBR payment

If you’re a new borrower after July 1, 2014, your payment is capped at 10% of your discretionary income:

- $13,130 × 10% = $1,313/year

- $1,313 ÷ 12 = $109.42/month

If you borrowed before July 1, 2014, the cap is 15%:

- $13,130 × 15% = $1,969.50/year

- $1,969.50 ÷ 12 = $164.13/month

This simple calculation shows how your IBR student loans remain tied to your financial situation, offering affordability and flexibility even if your income fluctuates over time.

How do I apply for an IBR plan and other IDR plans?

You can enroll in an income-driven repayment plan online via the U.S. Department of Education's website. If you have older loans, you might need to contact your loan servicer directly.

During the application process, you'll need to submit income verification documents. This data is critical for calculating your discretionary income and determining your payment amount.

After your initial enrollment, you’ll need to recertify your income and family size every year. Keep in mind that failing to provide this updated information promptly could result in higher monthly payments.

What are the benefits of the SAVE Plan?

The Saving on a Valuable Education (SAVE) Plan, available since 2023, automatically enrolls those previously on the REPAYE plan. SAVE lowers payments for most borrowers by basing them on a smaller portion of your discretionary income (5%).

Plus, it introduces an interest benefit - if you make your full monthly payment but it's not enough to cover the accrued interest, the government steps in to cover it, preventing your balance from increasing.

Although the SAVE plan offers many benefits, it is currently being blocked by federal courts, as of July 19, 2024. Borrowers enrolled in the SAVE plan will have their payments paused while the Education Department continues their legal battles.

Whether or not you should enroll in the IBR or SAVE plan depends on your specific financial situation. Note that the SAVE plan doesn’t have a monthly payment cap, so it might not be suitable if you expect your income to rise in the future.

Comparison of IDR plans

To help you choose the right plan, here’s a comparison of various IDR plans.

Repayment Plan | Payment % of Discretionary Income | Eligible Loans | Repayment Terms (Years) |

|---|---|---|---|

Income-Based Repayment (IBR) | 10% (post July 1, 2014), 15% (pre July 1, 2014) | Most Direct and Direct PLUS loans, Most FFEL and FFEL PLUS loans | 20 (post July 1, 2014), 25 (pre July 1, 2014) |

Income-Contingent Repayment (ICR) | 20% | No new enrollments except those with a consolidation loan that repaid a parent PLUS loan | 25 |

Pay As You Earn (PAYE) | 10% | No new enrollments | 20 |

SAVE plan (Undergraduates) | 5% | Most Direct and Direct PLUS loans, Most FFEL plus loans if consolidated | 20 (balances under $12,000 are forgiven after 10 years of payments) |

This table reveals the key differences between IDR plans, helping you determine the best option for your situation.

What is Public Service Loan Forgiveness (PSLF)?

The Public Service Loan Forgiveness (PSLF) program offers forgiveness for the remaining balance of Direct Loans after you make 120 qualifying monthly payments while working full-time for a qualifying employer. These employers typically include government organizations at any level, nonprofit organizations, and certain other types of not-for-profit organizations.

One crucial element is that payments made under an IDR plan count towards PSLF. So if you’re in public service, combining PSLF with an IDR plan could significantly maximize your benefits. For more about managing student loans, you can read our guide on strategies for managing student loan debt.

What to do if you can't afford your student loan payment

If you are unable to make your student loan payments, you should first contact your loan servicer. They can guide you through the options, like enrolling in an IDR plan, which tailors your monthly payments to your income and family size.

Another option might be temporary deferment or forbearance; however, interest will continue to accrue during these periods, potentially increasing the total loan cost.

Being proactive can prevent your loans from becoming delinquent or defaulting and affecting your credit score. Learn more about issues arising from student loan delinquency in our comprehensive overview: what happens to student loans when you die or if you declare bankruptcy.

By understanding how each IDR plan operates and determining if you qualify, you can make informed decisions about managing your student loan debt more effectively. You won’t just lower your payments; you’ll take a definitive step toward better financial health.

Dos and don'ts of using income-based repayment (IBR) plans

When considering an Income-Based Repayment (IBR) plan for managing your student loans, it's essential to be aware of the key practices that can maximize your benefits and pitfalls to avoid. Here are some critical dos and don'ts to guide you through the process.

Do

Explain the concept of discretionary income and its role in determining IBR payments.

Highlight the importance of annual recertification for income and family size.

Compare IBR with other Income-Driven Repayment plans, like PAYE and SAVE.

Mention the potential for loan forgiveness after 20 or 25 years under the IBR plan.

Don't

Overlook the potential for interest to accrue if payments don't cover it.

Assume all loans are eligible without confirming specific requirements.

Forget to address the impact of filing taxes jointly if married.

Neglect the administrative work required for annual recertification.

Advantages and disadvantages of using income-based repayment (IBR) plans

Income-Based Repayment (IBR) plans offer a way to manage student loan payments by capping them based on your income. This plan can provide relief through lower monthly payments and potential loan forgiveness, but it also comes with some drawbacks like longer repayment periods and possible interest accumulation. Here's a breakdown of the pros and cons to help you decide if an IBR plan is right for you.

- Lower monthly payments: Payments are capped based on discretionary income, making them more manageable.

- Eligibility for loan forgiveness: Any remaining balance may be forgiven after 20 or 25 years.

- Adaptable to income changes: Payments adjust with your income and family size, providing flexibility.

- Accessible for most borrowers: Open to new enrollees with federal student loans.

- PSLF eligibility: Qualifying payments can count towards Public Service Loan Forgiveness.

- Longer repayment period: Can extend loan term up to 25 years, increasing total interest paid.

- Interest accumulation: Payments may not cover interest, causing the loan balance to grow.

- Annual recertification required: Additional administrative work to update income and family size annually.

- Not always the lowest payment option: Other IDR plans might offer lower payments depending on circumstances.

- Potential higher payments for married borrowers: Joint income is considered if married and filing taxes jointly, potentially increasing payment amounts.

Reopening of income-driven repayment applications

As of March 26, 2025, the U.S. Department of Education has reopened applications for income-driven repayment (IDR) plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Income-Contingent Repayment (ICR).

This follows a temporary suspension prompted by a federal court injunction that blocked the Biden administration's Saving on a Valuable Education (SAVE) plan and affected other IDR programs.

The revised application process now complies with the court's ruling, allowing borrowers to apply through StudentAid.gov.

While application processing is resuming, some delays may occur as loan servicers update their systems. Borrowers are encouraged to stay informed about their repayment options and consult with their loan servicers for guidance.

Why trust TuitionHero

At TuitionHero, we help students and parents navigate student loans, including Income-Based Repayment (IBR) plans and refinancing options. Our tools and resources help you make informed financial decisions and manage your student loan debt.

Frequently asked questions (FAQ)

To apply for an Income-Based Repayment (IBR) plan, you'll need to provide proof of income (like a tax return or pay stubs) and family size information. This verification helps your loan servicer calculate your discretionary income and appropriate monthly payment. For more guidance on student loans, check out our guide on understanding student loans.

Yes, you can make extra payments at any time without penalty. Making extra payments can help you pay off your loan faster and reduce the amount of interest you pay over time.

However, remember that this won't lower your required monthly payment. Need more tips? Try our guide on managing student loan debt.

IBR payments may not always cover the accrued interest, especially if the payments are very low. However, for the first three years, the government pays the remaining interest for subsidized loans. For strategies on handling interest, consider exploring how to use a student loan calculator to plan your finances.

Yes, you can switch from an IBR plan to another IDR plan, depending on your eligibility. For example, moving from IBR to the SAVE Plan can be beneficial based on changes in your income or family size. For details on refinancing, which can also be a tool to lower your payments, visit our student loan refinancing section.

If you're married and file jointly, your spouse's income and federal student loan debt will be considered in calculating your IBR payment. This could result in a higher payment compared to filing separately.

There’s no fixed income limit, but you must demonstrate a partial financial hardship to initially qualify for IBR student loan plans. This means your required payment under IBR must be less than what you'd pay on a Standard 10-Year Plan.

If your income rises significantly, you may no longer qualify for income-based payments—but your payment will still be capped at the amount you were originally eligible for when you entered the plan.

For many borrowers, enrolling in an income-driven repayment plan like the IBR repayment plan is a smart move—especially if your income is low or unpredictable.

These plans offer lower monthly payments, flexibility, and potential loan forgiveness. However, they often result in paying more interest over time, so it depends on your financial goals and career path.

Final thoughts

Choosing the right repayment plan can significantly affect your financial future. For many borrowers with limited income or high student loan balances, IBR forgiveness provides a manageable path forward—especially with benefits like capped payments, forgiveness opportunities, and interest support on subsidized loans.

As you explore your options, take advantage of tools like the Department of Education’s Loan Simulator to estimate your savings. And remember: staying proactive with annual recertification and understanding what is IBR will help you make the most of your repayment strategy.

Source

Author

Brian Flaherty

Brian is a graduate of the University of Virginia where he earned a B.A. in Economics. After graduation, Brian spent four years working at a wealth management firm advising high-net-worth investors and institutions. During his time there, he passed the rigorous Series 65 exam and rose to a high-level strategy position.

Editor

Rachel Lauren

Rachel Lauren is the co-founder and COO of Debbie, a tech startup that offers an app to help people pay off their credit card debt for good through rewards and behavioral psychology. She was previously a venture capital investor at BDMI, as well as an equity research analyst at Credit Suisse.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today

Compare Personalized Rates