Advertiser Disclosure

Last update: June 6, 2025

8 minutes read

How to Split Up Your Joint Consolidation Student Loan (A Guide)

Learn step-by-step how to complete joint consolidation loan separation, calculate new balances and submit your application. Regain control of your student debt.

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

Separating a joint consolidation student loan can seem overwhelming, but it’s an important step toward regaining financial independence—especially if you’re dealing with spousal consolidation student loans divorce complexities.

Thanks to the Joint Consolidation Loan Separation Act, borrowers can split a once-combined loan into two individual Direct Consolidation Loans. This guide walks you through exactly how the numbers work and what to expect after you apply, so you can move forward with confidence.

Key takeaways

- Verify your eligibility for loan separation under the Joint Consolidation Loan Separation Act, passed in 2022

- Contact your loan servicer to request forbearance while awaiting the separation process

- Borrowers can submit a loan separation request on their own under certain circumstances, such as an uncommunicative former partner

What is a joint consolidation student loan separation?

Separating your joint consolidation student loan means splitting one combined loan into two individual loans. This process allows each borrower to take responsibility for their portion of the debt. It's particularly useful for those facing divorce, financial abuse, or other challenging circumstances.

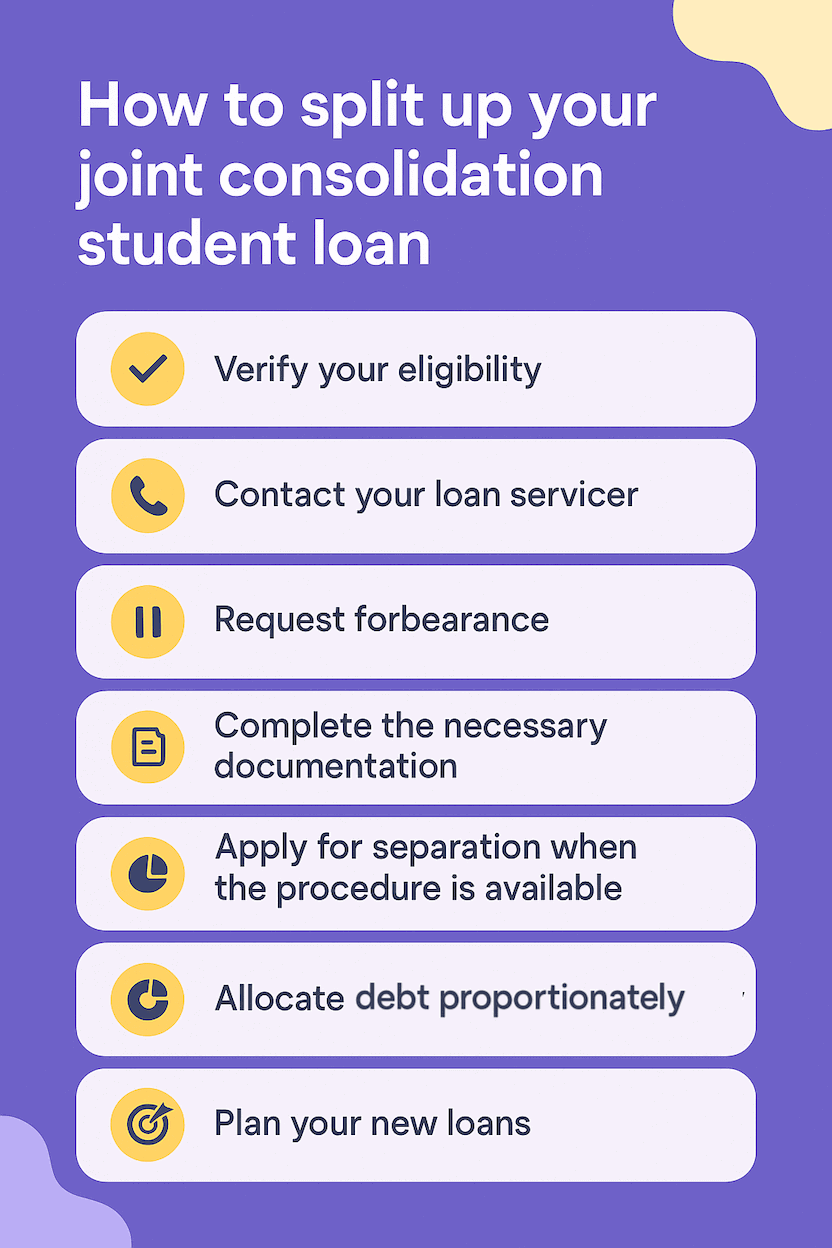

How to split up your joint consolidation student loan

Separating a joint consolidation student loan is now possible thanks to the Joint Consolidation Loan Separation Act, passed in 2022. Although it has already been passed, implementation won’t begin until the end of 2024. Stay up to date, but know the rules in the meantime to get prepared. Here’s a step-by-step guide to help you through this process.

Step 1: Verify your eligibility

First, check if you’re eligible under the new regulations. The Joint Consolidation Loan Separation Act caters specifically to married couples who consolidated individual loans together but now want to split those loans back up.

Step 2: Contact your loan servicer

You must reach out to your loan servicer to request a separation. Typically, both borrowers are required to complete the separation application together. However, in cases of economic or financial abuse, or if a former partner cannot be reached, then a single borrower can complete the application.

Step 3: Request forbearance

While waiting for the full implementation, you can request that your loan be placed into forbearance. This halts payments temporarily so you are not marked as delinquent, although interest may still accrue. Contact your servicer directly for this.

Step 4: Complete the necessary documentation

Fill out the required forms for forbearance and indicate why you need to separate the loans. Ensure you explain whether you’re facing issues like divorce or financial abuse.

Step 5: Apply for separation when the procedure is available

The official loan separation process isn't expected to start taking effect until late 2024. Stay updated with your loan servicer and the Department of Education for updates.

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

Step 6: Allocate the debt proportionately

Once the separation process begins, your debt will be divided based on the proportion of the original amount owed. Make sure to understand how this allocation works.

Step 7: Plan your new loans

After separation, you will have to manage an individual consolidation loan. This might be a good time to explore other loan options, like refinancing for potentially better rates.

Handling special circumstances

While most steps apply generally, some borrowers face unique challenges. If you are a victim of domestic or economic abuse, or if your partner is uncommunicative, you can initiate the separation process individually without their consent.

How to calculate your new balances

Let’s break it down step by step, using numbers you can follow easily:

- Start with the original joint loan and each person’s share

- The couple originally owed $80,000 together.

- Spouse A’s original loans were $20,000, which is 25% of $80,000.

- Spouse B’s original loans were $60,000, which is 75% of $80,000.

- Find the current outstanding balance

- Together, they now owe $45,000 on that joint loan.

- Multiply the current balance by each person’s percentage

- Spouse A’s calculation:

- 25% of $45,000 → 0.25 × 45,000 = $11,250

- Spouse B’s calculation:

- 75% of $45,000 → 0.75 × 45,000 = $33,750

- Spouse A’s calculation:

- Resulting new loan balances :

Borrower | Percentage of Original Debt | Calculation | New Balance |

|---|---|---|---|

Spouse A | 25% | $45,000 x 0.25 | $11,250 |

Spouse B | 75% | $45,000 x 0.75 | $33,750 |

What happens after you apply for your joint consolidation loan separation

- Acknowledgment: Within about 30 days of submitting your joint consolidation loan separation application, you’ll receive a confirmation from the Department of Education that your request was received.

- Servicer assignment: Your two new Direct Consolidation Loans will be sent to the loan servicer you picked (for example, FedLoan, Nelnet, or Mohela).

- Payment count update: After the loans are set up, check your PSLF Help Tool or income-driven repayment dashboard—any qualifying payments you made before separation will be added to your new loan account once the joint consolidation loan separation is processed.

- Resume or start repayments: You’ll receive a repayment schedule showing your first payment date. At that point, enroll (or re-enroll) in an income-driven repayment plan if you want, and begin making payments on your new individual loans.

TuitionHero Tip

By following each step diligently and staying updated on policy changes, you can successfully separate your joint consolidation student loan and regain financial independence.

Dos and don'ts of splitting up your joint consolidation student loan

When separating a joint consolidation student loan, carefully consider each action to make the process as smooth as possible. Here's a quick guide to what you should and shouldn't do.

Do

Check your eligibility

Contact your loan servicer

Request forbearance

Fill out forms accurately

Stay updated on policy changes

Don't

Ignore deadlines

Assume your loans are separated

Forget to document correspondence

Skip sections on forms

Wait until the last minute

More tips for splitting up your joint consolidation student loan

Successful separation involves several strategies. Here are some more tips to help you navigate this process efficiently.

- Keep thorough records: Document every step and correspondence with loan servicers.

- Consult a financial advisor: Get expert advice on how to manage your loans post-separation.

- Stay updated: Regularly check for updates from the Department of Education.

- Consider refinancing options: Explore whether refinancing your new individual loan could lead to better terms.

- Understand the interest implications: Calculate how possible interest accrual during forbearance affects your payments.

- Communicate with co-borrower: If possible, maintain open communication with the other borrower to simplify the process.

- Prepare for the application process: Have all necessary documentation ready before the separation process officially begins.

- Seek legal aid if necessary: In cases of domestic or economic abuse, legal assistance can provide more support.

By following these extra tips and maintaining a proactive approach, you'll navigate the separation of your joint consolidation student loan effectively.

Advantages and disadvantages of splitting up your joint consolidation student loan

Understanding the pros and cons of separating your joint consolidation student loan is vital. Let's look at what you gain and the potential drawbacks to consider.

- Individual responsibility: Each borrower is accountable only for their portion of the loan.

- Flexible repayment plans: Both borrowers can choose repayment plans that suit their financial situations.

- Better access to forgiveness programs: You can individually pursue Public Service Loan Forgiveness (PSLF) or other programs.

- Enhanced credit score management: You can manage your credit score more effectively without the burden of your co-borrower’s financial history.

- Simplified divorce proceedings: It eases financial entanglements during divorce or separation.

- Interest accumulation: Interest may accrue during forbearance, increasing the total amount owed.

- Potential legal complexities: Navigating loan separation amid hostile conditions, like divorce or financial abuse, can be legally and emotionally taxing.

- Long waiting period: The full implementation isn’t expected until late 2024, prolonging your financial uncertainty.

- Documentation burden: The process requires significant paperwork and reliable documentation.

- Inconsistent loan servicer cooperation: For borrowers with commercially-held FFEL loans, loan-holder cooperation for forbearance is encouraged but not guaranteed.

By weighing these advantages and disadvantages, you can make a more informed decision about whether separating your joint consolidation student loan is the right path for you.

Why trust TuitionHero

At TuitionHero, we help students and parents manage and separate joint consolidation student loans. We offer student loan refinancing, private student loans, and FAFSA assistance tailored to your needs. Overwhelmed by loan separation? Trust us to simplify the process and guide you through every step.

Reopened consolidation & repayment tools

On March 27, 2025, the Department’s Office of Federal Student Aid reopened its online income-driven repayment plan and Direct Consolidation Loan applications—important for any borrower separating a joint loan who wishes to enroll quickly in an IDR plan.

Additionally, as of May 2025, the Department is preparing to resume applications for streamlined payment plans and to enforce collections more aggressively—a reminder to stay current on correspondence and application deadlines if you want to lock in benefits like payment-count adjustments toward forgiveness programs.

Frequently asked questions (FAQ)

Yes, you can voluntarily make payments during the forbearance period. This can help you manage the accruing interest and reduce the overall loan balance. Both co-borrowers can make voluntary payments even if the loan is in forbearance.

You can still initiate the separation process on your own. The Joint Consolidation Loan Separation Act allows you to proceed individually, especially in cases of domestic or economic abuse, or if you can’t reach your co-borrower.

Separating your joint consolidation loan can positively affect your credit score by giving you full control over your portion of the debt. This way, you're not affected by your co-borrower's financial decisions, which allows for better credit management.

Splitting the loan allows each borrower to apply for income-driven repayment plans individually. This can result in more favorable payment terms because each loan will be assessed based on the individual borrower's income and financial circumstances, rather than a combined income.

Yes, borrowers with commercially held FFEL joint consolidation loans can apply for separation. However, they must request that their loan holders offer a forbearance or payment suspension while awaiting the separation process. Cooperation from FFEL loan holders is encouraged but not guaranteed.

Request forbearance to temporarily halt payments. This will provide some financial relief while you wait for the separation process to become fully implemented. For more strategies on managing student loan debt, check out our dedicated financial strategies page.

Yes—if you have a joint consolidation loan, you can separate it into two individual Direct Consolidation Loans under the Joint Consolidation Loan Separation Act of 2022.

You’ll submit an application (either jointly or, in certain hardship cases, separately), and once approved, each borrower’s share of the current balance is split based on the percentage of the original debt they brought into the consolidation.

The Joint Consolidation Loan Separation Act of 2022 is the law that lets married borrowers unwind their old joint consolidation loans.

It creates two application paths—one where both borrowers apply together, and another where an individual can apply alone in cases of domestic violence, economic abuse, or an unresponsive co-borrower.

Once processed, the old loan is closed and replaced by separate Direct Consolidation Loans for each borrower.

Not today. The federal program that once allowed spousal consolidation student loans ended on July 1, 2006.

You cannot create a new joint consolidation loan now. Instead, you each hold your own federal loans and can separately pursue consolidation into individual Direct Consolidation Loans if desired.

Final thoughts

Whether you have older spousal consolidation student loans or more recent joint spousal consolidation loans, separating your debt through the spousal consolidation loan separation process can be vital.

This student loan spousal consolidation separation not only clarifies your payment obligations but also paves the way for tailored repayment strategies and forgiveness options.

Keep track of deadlines, gather the right documents, and stay in touch with your servicer to ensure a smooth transition to financial freedom.

Source

Author

Brian Flaherty

Brian is a graduate of the University of Virginia where he earned a B.A. in Economics. After graduation, Brian spent four years working at a wealth management firm advising high-net-worth investors and institutions. During his time there, he passed the rigorous Series 65 exam and rose to a high-level strategy position.

Editor

Rachel Lauren

Rachel Lauren is the co-founder and COO of Debbie, a tech startup that offers an app to help people pay off their credit card debt for good through rewards and behavioral psychology. She was previously a venture capital investor at BDMI, as well as an equity research analyst at Credit Suisse.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today

Compare Personalized Rates