Advertiser Disclosure

Last update: June 6, 2025

12 minutes read

10 Jobs That Qualify for Public Service Loan Forgiveness (PSLF)

Discover top PSLF jobs and strategies to maximize Public Service Loan Forgiveness. Explore waivers, forbearance credits, and PEO exceptions to erase your student debt.

By Derick Rodriguez, Associate Editor

Edited by Brian Flaherty, B.A. Economics

Learn more about our editorial standards

By Derick Rodriguez, Associate Editor

Edited by Brian Flaherty, B.A. Economics

Learn more about our editorial standards

Public service careers offer more than just meaningful work—they can also pave the way to significant student debt relief by highlighting what jobs qualify for student loan forgiveness.

Whether you’re on the front lines in healthcare, shaping young minds in education, or supporting communities through nonprofit work, this guide uncovers the top loan forgiveness jobs you might not have considered.

Get ready to explore insider strategies that turn your public service into a direct route to debt freedom.

Key takeaways

- Teachers and educators are prime candidates for PSLF

- Full-time volunteering with the Peace Corps or AmeriCorps counts towards PSLF

- Staying on an appropriate payment plan and making 120 qualifying payments are essential components to achieve loan forgiveness

Which jobs qualify for Public Service Loan Forgiveness?

Paying off your student loans for 120 months might feel like a super long race. But guess what? You could be on the way to getting Public Service Loan Forgiveness (PSLF) and saying goodbye to that debt!

If you're working for the government or a non-profit, you might have a special ticket to get rid of your student loans. Let's break it down with a list of jobs that could be your ticket to PSLF freedom.

1. Teachers shaping minds

Teachers, give yourselves a pat on the back! Your hard work can actually qualify you for PSLF (Public Service Loan Forgiveness).

Whether you're teaching the ABCs or prepping teens for college, the government thinks you're doing a great job. This benefit works well for educators in public schools, state-funded pre-K, and Head Start programs.

So, if you're the one creating lesson plans, you're on the right path. We know you're busy with lesson plans and grading, and your student loan balance might not be top of mind.

But here's the cool part—your commitment to education is more than just a job; it can help wipe away your student loan debt. Check out TuitionHero for all the details on PSLF. We’ve got everything you need, from choosing the best repayment plan to handling paperwork like a pro.

2. Nurses and public health heroes

Shoutout to nurses! Whether it's a 12-hour shift or a patient's smile, it all counts toward Public Service Loan Forgiveness (PSLF).

If you work in public hospitals or community health centers, your hard work might really pay off. And hey, it's not just nurses; nurse practitioners, doctors, and clinical support staff all qualify for PSLF too. Taking care of people is your superpower!

3. Law and order leaders

Hey, law enforcers and legal experts! Your job is more than just laws and files; it's about helping the public.

Whether you're a cop, detective, or public defender, you're the ones keeping our streets and justice system in check. And if you've picked public service over a big paycheck, Public Service Loan Forgiveness (PSLF) is like your financial superhero.

Chasing down testimonies and solving cases might be a regular Tuesday for you, but while you're doing that, PSLF could be your backup plan.

TuitionHero Tip

With the right moves—like using income-driven repayment plans and keeping your Employment Certification form in check—TuitionHero is here to guide you through each step. We’ll make loan forgiveness less confusing and more of a win.

4. Social workers with hearts of gold

If you’re a social worker, you're not just dealing with paperwork or home visits—you're out there making a real difference in people's lives, especially for kids and families who really need it. Whether you're working on child welfare or mental health, your dedication qualifies you for PSLF, a program that appreciates the big job you do with an even bigger heart.

5. Emergency management professionals

Emergency managers, you're the calm in the chaos, planning responses to disasters while most are still brewing their morning cup. If your office is a hub for crisis control—think FEMA, public health emergencies, or local fire departments—your gig could lead to PSLF. It's about being prepared and making a difference when seconds count.

6. Government workers

Hey public sector champs! Your daily work in government could be your ticket to getting rid of those loans.

Whether you're a city planner, public affairs specialist, or deep in bureaucracy, your job is eligible for PSLF (Public Service Loan Forgiveness). It's not just about paperwork; it's about making our society run smoothly.

7. Military service members

To our brave service members, PSLF is here to salute your dedication to keeping our nation safe. Whether you're on active duty or serving full-time reserves, your sacrifices could make you eligible for loan forgiveness—a small way of saying thank you for your hard work.

Navigating the path to loan freedom might feel like a different kind of battle, but it's a fight worth fighting with a smart strategy. TuitionHero understands the process and is ready to help you bring attention to and efficiently dismiss that loan balance, relieving you of your financial burdens as a gesture of gratitude for your service to our country.

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

8. Librarians and literacy leaders

To all you librarians out there, your work is more than just quiet shelves; you're leading the way to knowledge and discovery, making you eligible for PSLF (Public Service Loan Forgiveness). Whether you're a public library scientist or part of a school library team, your impact on literacy can lead to loan forgiveness.

9. Public safety protectors

Hello to all the awesome firefighters and first responders! You guys are always ready to help when there's trouble, and the Public Service Loan Forgiveness (PSLF) program understands how important your job is. It's really cool that the fast way you respond to emergencies can also be matched by getting some benefits from this program.

10. Environmental engineers

Hey eco-heroes, if you're working hard to protect our environment, from handling waste to keeping water clean, and you're part of a group dedicated to this cause, the PSLF might help wipe out your student debt. Just make sure your employer is the government or a non-profit - private engineering firms don’t count!

TuitionHero Tip

While you battle climate change and other environmental issues, TuitionHero is here to help you with the tricky process of student loan forgiveness. We're ready to help you grow financial freedom, so your future—and the planet—can be free from debt.

What is Public Service Loan Forgiveness and why does it matter?

PSLF is like a helping hand for people with student loans who've dedicated themselves to public service. It's the government's way of saying "thanks" by wiping out federal student debt after you make 120 qualifying payments.

This program is a big relief for your wallet and a recognition of your service to the community. Knowing about PSLF is super important for anyone in public service because it can help you get rid of the heavy load of student loans.

This way, you can focus on your important work without money worries. Whether you're saving lives, teaching, or keeping things in order, PSLF is your chance to free yourself from money stress—a well-deserved reward for your public service.

This program is for many public servants like teachers, nurses, law enforcement, social workers, emergency managers, government employees, military personnel, librarians, public safety officials, and environmentalists. If you're in one of these jobs, PSLF could be a big help for your finances.

Temporary expanded PSLF (TEPSLF) & waivers

Even if you’ve been denied PSLF before, don’t lose hope—TEPSLF and limited-time waivers could get you back on track. The Temporary Expanded PSLF (TEPSLF) acts as a safety net for borrowers whose payments or repayment plans initially fell short of PSLF rules.

Meanwhile, the Department of Education’s one-time waiver retroactively counts past months in deferment, forbearance, or on the wrong plan toward your 120-payment requirement.

Key steps:

- Re-submit your PSLF form: Include any unpaid deferment or forbearance periods, even gaps in employment.

- Document everything: Attach pay stubs or W-2s for those retroactive months to speed processing.

- Watch deadlines: These relief options are time-limited—check studentaid.gov for current cutoff dates.

TuitionHero Tip

If you’ve held student loan forgiveness jobs in the past, revisit your application now—those months may still count.

PEO & contractor exception explained

If you receive your paycheck from a payroll provider (PEO) but actually serve a government agency or nonprofit, you still qualify for PSLF—thanks to the PEO exception.

A PEO handles HR and payroll, but doesn’t change your status as an employee of the qualifying organization.

To claim this exception:

- List the right EIN: On your PSLF form, enter the government/nonprofit employer’s EIN—not the PEO’s.

- Get the right signature: Have an authorized official from the qualifying employer certify your service, even if your W-2 bears the PEO’s name.

- Double-check state rules: In some states, contracting through a separate entity is mandatory; keep documentation showing you provided essential services that only the qualifying employer could offer.

TuitionHero Tip

Remember, understanding what jobs qualify for pslf means knowing these nuances—PEO-employed nurses, therapists, and admin staff all count.

Maximizing forbearance & deferment credits

Pauses in repayment don’t have to stall your PSLF progress—certain deferments and forbearances actually count as qualifying payments once you certify your employment.

Under recent updates, months spent in economic hardship, military service, AmeriCorps forbearance, and other eligible pauses are auto-credited to your total, thanks to CARES Act provisions and new DOE guidance.

How to leverage these credits:

- Consolidate smartly: Move FFEL or Perkins loans into a Direct Consolidation Loan before applying; pre-consolidation payments will transfer in.

- Certify employment: For each paused month, submit an Employment Certification Form (ECF) showing you worked full-time for a qualifying employer.

- Track your count: Use the PSLF Help Tool dashboard to verify that deferment months are being applied.

Dos and don'ts of qualifying for PSLF

Navigating the PSLF program can be as tricky as a high-stakes obstacle course. But don’t worry! We've got some dos and don'ts to help you make all the right moves and avoid the common pitfalls.

Do

Work full-time for a qualifying employer.

Make 120 qualifying payments.

Fill out the paperwork yearly.

Follow the rules closely.

Don't

Work for a non-qualifying employer.

Use a non-applicable payment plan.

Ignore annual certification.

Don't give up if things get a bit complicated.

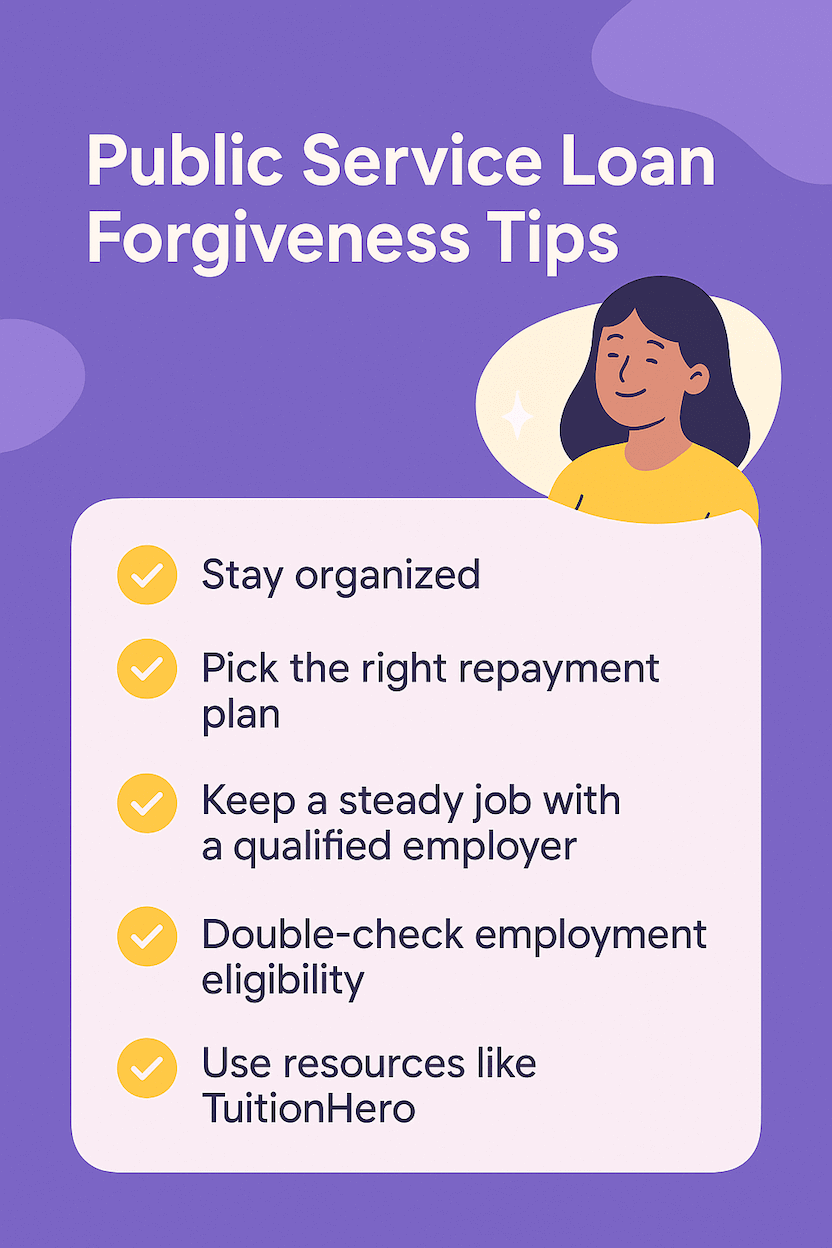

More public service loan forgiveness tips

Just when you thought you had the full road map to PSLF laid out, we're tossing in a few extra tips to make sure you're cruising without detours.

- Stay organized: Treat your PSLF paperwork like your taxes—keep everything tidy and on point.

- Pick the right repayment plan: Only income-driven repayment plans or the standard repayment plan are eligible for PSLF.

- Keep a steady job with a qualified employer: Stability is key, just like it’s important to stay consistent with your exercise routine.

- Double-check employment eligibility: Make sure your job fits the PSLF mold, like matching the dress code for a gala event.

- Use resources like TuitionHero: Think of them as your personal PSLF trainer—there to keep you focused and informed.

Advantages and disadvantages of public service loan forgiveness

When it comes to slicing through the thicket of student loans, the Public Service Loan Forgiveness program is like a financial machete. But just like a dense jungle, there are both wondrous sights and hidden pitfalls. We are taking a detailed trek through the pros and cons of the PSLF program, so buckle up as we chart this crucial terrain.

- No more loan shackles: After those 120 payments, you could be as free as a bird.

- Incentivizes public service: It's like a reward for your service to the community.

- Offers peace of mind: Knowing there's an end in sight can give you a breath of relief.

- Helps with long-term planning: Like popping the bubbly when you pencil in your debt-free date.

- May encourage higher education: It's the light at the end of the academic tunnel.

- Strict eligibility requirements: Missing a tick box can be like stepping on a landmine.

- Complex application process: The process of applying for forgiveness can get complicated.

- Commitment to public service jobs: You need to commit to a job in public service for a long time.

- Tax implications for some people: The forgiven amount isn't taxable, but state taxes may differ.

- Program changes could affect forgiveness: Program terms might shift unexpectedly.

Executive orders and legislative threats

On March 7, 2025, President Trump signed Executive Order 14235, “Restoring Public Service Loan Forgiveness,” directing the Departments of Education and Treasury to tighten PSLF eligibility—potentially disqualifying employees of organizations deemed to have a “substantial illegal purpose” from forgiveness.

At the same time, House Republicans introduced legislation empowering the Treasury Secretary to strip nonprofits of tax-exempt status for alleged terrorism support, which would immediately revoke PSLF eligibility for thousands of public service workers.

Why trust TuitionHero

At TuitionHero, we're your go-to for simplifying student loan complexities. We equip you with tools to manage Private Student Loans, optimize Student Loan Refinancing, uncover Scholarships, navigate the FAFSA, and assess Credit Card Offers. For Public Service Loan Forgiveness, we're your strategic partners, making financial planning a breeze. Let's team up and conquer your loans together!

Frequently asked questions (FAQ)

Yes! Diving into full-time volunteering with the Peace Corps or AmeriCorps can help you qualify for PSLF. Your dedicated service counts toward those 120 payments, paving the way for possible loan forgiveness.

Yes, you can! It's like keeping your place in line even if you hop to a different queue. If your new gig is still with a PSLF-qualifying employer, those payments you've already made still count. So don’t worry, your progress is safe.

Nope, you're free to switch it up. As long as you're on one of the qualifying income-driven repayment plans when making each payment, you're in the clear. Also, note that the standard 10-year repayment plan can also qualify you for PSLF - but benefits are usually greatest under an income-driven plan.

Good news! Juggling part-time roles at different qualifying employers is cool with PSLF, as long as your combined work hours hit that 30-hour weekly sweet spot. It's like piecing together a full-time gig with puzzle pieces from different boxes.

Yes! Snagging Teacher Loan Forgiveness doesn't toss you out of the PSLF ring, but the clock for those 120 payments will start after receiving Teacher Loan Forgiveness. So, strap in for a new count towards that glorious zero balance.

PSLF itself doesn’t provide regular payments—instead, it forgives your remaining federal Direct Loan balance once you’ve made 120 qualifying payments under an eligible repayment plan while working full-time for a qualifying employer.

The “payoff” is the cancellation of whatever balance remains after that milestone.

- Employment Certification Forms: Typically reviewed within 30–90 days after submission.

- Final forgiveness application: Once you hit 120 payments and submit your PSLF application, expect another 30–90 days for review and approval.

Overall, from first certification to final discharge can span 10+ years (the 120-payment requirement), plus a few months for processing at each step.

Final thoughts

PSLF can be complex, but you don’t have to navigate it alone. Think of us as your student loan hero jobs guide—helping you identify the right roles and strategies at every turn. Keep your documentation organized, recertify annually, and revisit your application as new relief options emerge.

Armed with these insider tactics, you’ll be ready to pursue jobs that qualify for PSLF, discover jobs that forgive student loans, and position yourself among the best public service loan forgiveness jobs in your field. Your dedication to serving others deserves a clear path to financial relief—start exploring today!

Source

Author

Derick Rodriguez

Derick Rodriguez is a seasoned editor and digital marketing strategist specializing in demystifying college finance. With over half a decade of experience in the digital realm, Derick has honed a unique skill set that bridges the gap between complex financial concepts and accessible, user-friendly communication. His approach is deeply rooted in leveraging personal experiences and insights to illuminate the nuances of college finance, making it more approachable for students and families.

Editor

Brian Flaherty

Brian is a graduate of the University of Virginia where he earned a B.A. in Economics. After graduation, Brian spent four years working at a wealth management firm advising high-net-worth investors and institutions. During his time there, he passed the rigorous Series 65 exam and rose to a high-level strategy position.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today

Compare Personalized Rates