Advertiser Disclosure

Last update: June 11, 2025

10 minutes read

What is the Minimum Age to Apply for a Credit Card in 2025?

Learn the minimum age for credit card eligibility, how old you have to be to apply, and top strategies to build credit responsibly from day one.

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

Embarking on your first credit card journey is a big step toward financial independence—and it doesn’t have to be overwhelming.

In this post, we’ll dive beyond the age requirements to answer what age can you get a credit card, explain how old do you have to be to get a credit card, and show you the habits that shape a strong score.

By the end, you’ll have clear, actionable guidance to start building—or guiding someone else on—the path to solid credit.

Key takeaways

- You have to be at least 18 years old to apply for a credit card in the U.S.

- If you're under 21, you need some independent income or a cosigner to get a credit card

- Credit card issuers heavily consider your credit score and income even if you're 21+

How old do you have to be to get a credit card?

According to U.S. federal law, specifically, the Credit CARD Act of 2009, a consumer can apply for a credit card at 18 years old. But, it's not as simple as hitting the magical number 18.

You see, there are certain requirements for credit cards set by the law that play a key role before you can get one, even if you’re over 18. So, understanding credit card age limits is essential for young adults striving for financial independence.

What does the law say about getting a credit card at 18?

Not only do you need to be 18, but the law also requires applicants to either have some independent income source or a co-signer. In simpler words:

- You need to make enough money on your own to meet the income requirements for student credit cards,

- Have a co-signer. This person guarantees to pay your credit card balance if you can't.

Independent income typically includes wages, salaries, tips, or other earnings that are reported on your tax returns. This ensures that you have the financial means to manage the credit card responsibly.

What happens if you're under 21 and want a credit card?

Well, here's where it gets tricky. If you're under 21 and don't meet the criteria mentioned above (i.e., you don't have an independent income), here’s what you can do:

- Authorized user: One of your best moves could be to become an authorized user on a parent's or another person's credit card account. This person should preferably have a good credit history (because their credit behavior will now affect yours). As an authorized user, you can use the card without being responsible for making payments. Plus, this status will also help in your credit-building journey, a process known as credit card piggybacking. It can, in some cases, hurt your credit if the person isn’t responsible with the credit card, so make sure you trust their financial behavior.

- Learn moreCosigner: Alternatively, if you're at least 18, you can apply for a credit card with a cosigner. Again, this person with good credit and income assures to pay your credit card balance if you don't. However, most major card issuers don't allow cosigners these days. Credit cards that allow cosigners are limited, so consider this option carefully.

TuitionHero Tip

When you have a cosigner, it’s important to understand that any missed payments can hurt both your credit score and the cosigner’s credit score. This shared responsibility emphasizes the need for open communication and financial accountability between you and your cosigner.

Will you automatically get approved after turning 21?

Here's a dose of reality: Being 21 or above doesn't give you automatic approval for a credit card. Even though restrictions drop off at 21, approval is not guaranteed. Many credit card issuers weigh your credit scores and income while considering your application.

Even if you're under 21, establishing some form of credit, like through a secured credit card for young adults or becoming an authorized user, can help you build a credit history that may improve your chances of approval once you reach 21.

So, how can young adults start their credit journey?

So you've just turned 21 and are thinking about establishing your credit profile, despite being a little wet behind the ears credit-wise. Don't worry, there are a few credit card options for you to consider:

- Secured credit cards: These cards require an upfront security deposit, usually equal to the credit limit. If you fail to make payments, the deposit protects the issuer. But guess what? You'll get the deposit back when you close or upgrade the account. Secured cards are great for people looking to start building credit.

- Student credit cards: Some cards come with benefits for college students. However, you'll generally need some income and at least a fair credit score to get approval.

- Alternative credit cards: We've also seen an influx of alternative credit cards in the market lately. They use nontraditional policies to assess your creditworthiness, like cash flow, but you'll still need to meet the income requirements just like traditional credit cards. The key selling point? They don't require deposits.

- Credit builder loans: Apart from credit cards, credit builder loans are another excellent tool for young adults to establish credit. These small loans are designed to help people build credit by making regular payments that are reported to credit bureaus.

Are there exceptions to these rules?

Yes! The Credit Card ACT of 2009 allows credit card applications with cosigners, which could be your workaround. However, keep in mind - most major card issuers don't allow co-signers. But hey, don't lose hope, you may have better luck with smaller banks and credit unions, who often offer much better interest rates on credit cards anyway.

What are credit unions? They are financial not-for-profits where people in your community or state can pool and borrow money - they work just like a bank but with lower fees/rates and more of a community feel.

Credit unions often provide personalized customer service and may offer financial education resources that can help young adults manage their credit responsibly. Plus, they may have more flexible approval criteria for first-time credit card applicants.

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

Dos and don'ts of getting your first credit card

Starting your credit journey is an exciting step. But like any journey, it comes with do’s and don'ts. Sticking to these will help protect you from the risks of debt and bad credit. Let's take a closer look:

Do

Start with a secured credit card or as an authorized user

Always pay your bills on time

Stick to a budget

Check your credit score regularly

Don't

Jump into multiple credit cards at once

Ignore late payment dues

Overspend on your credit card

Apply for a credit card without understanding its terms

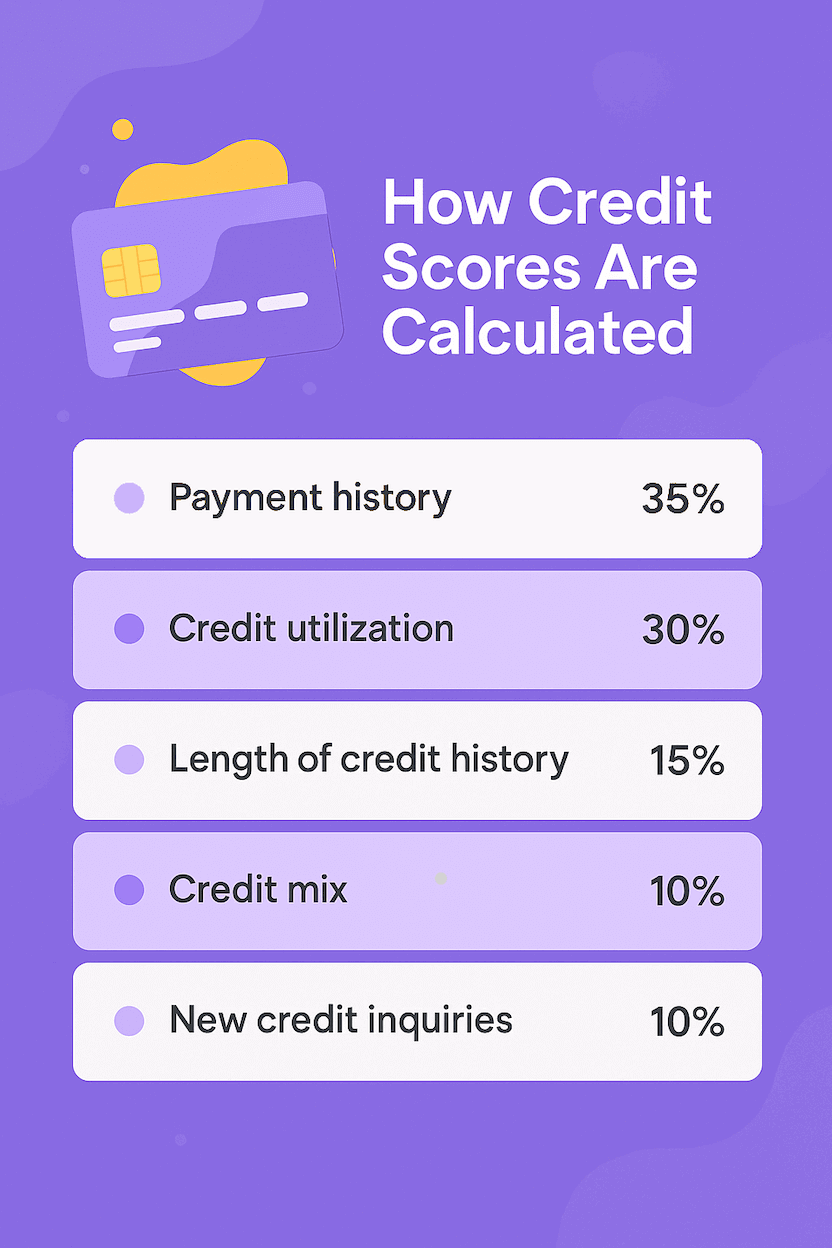

Understanding how credit scores are calculated

Many first-time cardholders don’t realize how their behavior maps to their FICO® scores. Here’s a quick primer on the five factors that matter—and the weight each carries:

- Payment history (35%): On-time payments are king. Even one late payment can ding your score for months, so always pay at least the minimum by the due date.

- Credit utilization (30%): Aim to keep your balance under 30% of your limit. For example, on a $500 limit, try not to carry more than a $150 balance at statement close.

- Length of credit history (15%): The longer your accounts have been open, the better. Becoming an authorized user on a seasoned account can boost this faster than waiting for your own card to age.

- Credit mix (10%): Having both a revolving account (credit card) and an installment account (like a credit-builder loan) shows lenders you can handle different types of credit responsibly.

- New credit inquiries (10%): Soft inquiries (pre-approvals) don’t hurt, but hard inquiries (actual applications) can shave a few points—so compare offers with soft pulls first and apply sparingly.

Regardless of the minimum age for credit card applications, understanding your score early gives you an edge. And before you even meet the credit card age requirement, you can start by checking your credit report or becoming an authorized user.

Advantages and disadvantages of getting a credit card early

While getting your first credit card is a fundamental step towards financial independence, like most things, it comes with its own sets of advantages and disadvantages.

- Establishing a strong credit history for future financial prospects

- Providing the flexibility to manage emergency expenses

- Earning rewards and cashback on spending

- The risk of falling into debt due to mismanagement of payments

- The potential to damage your credit score if not handled responsibly

- Possibility of overspending, leading to significant financial stress later on

How do I know my child is ready for a credit card?

Deciding when to give your teen access to credit is as important as knowing the age rules.

Parents often wonder "Can a 17 year old get a credit card?"—the truth is minors can’t be primary holders but can join accounts responsibly.

Determining the age to get a credit card involves more than just birthdays. Look for these signs of readiness:

- Consistent responsibility with money: Have they demonstrated reliable habits—like saving allowance or covering small expenses without reminders?

- Understanding of budgeting: Can they explain how they’d track spending, set limits, and avoid overspending?

- Awareness of interest and fees: Do they grasp that carrying a balance costs money in interest, and that late payments incur fees and credit damage?

- Open communication about spending: Are they willing to share statements and discuss charges, so you can coach them and catch issues early?

- Ability to make on-time payments: If you set up a small recurring charge (e.g., a streaming service), do they reliably cover it each month?

If your child checks these boxes, starting them as an authorized user—or guiding them through a secured or student card—can be a powerful lesson in financial responsibility.

Why trust TuitionHero

Getting your first credit card can be intimidating, but TuitionHero simplifies finance for students and parents. We offer guidance on student loans, scholarships, credit cards, and more. We also assist with student loan refinancing and FAFSA for better financial aid. With TuitionHero, you'll have reliable financial education for college finance matters.

Credit unions partnering with fintech to help teens build credit

In early 2025, SPC Credit Union teamed up with fintech Greenlight to launch a debit-plus-credit solution that teaches kids and teens to earn, save, give, and spend wisely—while enabling them to build credit as authorized users under parental supervision.

Shortly after, Metro Credit Union (Massachusetts’ largest state-chartered credit union) also announced a partnership with Greenlight to offer the same Family Cash Mastercard program, reinforcing a broader movement among credit unions to help minors develop healthy credit habits before age 18.

Frequently asked questions (FAQ)

Secured credit cards, student credit cards, making full payments on time, and being an authorized user on a credit card with healthy credit activity are all great ways to build your credit as a young adult.

Start by ensuring you meet the minimum income and age requirements. Building a good credit history by paying your bills on time, keeping your credit utilization below 30%, and fixing any errors in your credit report can boost your chances considerably.

With consistent and responsible credit habits, it's possible to establish a decent credit score within six months to a year of opening a credit card. Timely payments, low credit utilization, and a mix of credit types contribute to a good score.

A good credit score opens doors to financial freedom - from being approved for apartments and loans, to securing lower interest rates on credit products, and even favorable terms on insurance policies. Plus, if student loans are part of your college plan, lenders may be more willing to grant loans to students with a good credit score.

Contact your credit card issuer immediately to discuss your options. They may offer payment plans or temporary relief to help you avoid late fees and damage to your credit score.

No, the legal age for credit cards is 18. However, minors can build credit by becoming an authorized user on a parent's credit card or through other means like credit builder loans.

At 16, you can’t open your own credit accounts, but you can start laying groundwork:

- Become an authorized user on a parent’s or guardian’s card—if the issuer reports your activity, you’ll begin to build a credit history.

- Learn budgeting habits by managing a checking or savings account and paying any small recurring charges (like a streaming service) on time.

- Educate yourself about credit: track your parent’s statements with them, set spending limits, and practice on-time payments.

Most issuers set a minimum age (often 13 or older) to add an authorized user; very few allow children as young as 12.

Even if you can add them, check whether the issuer reports authorized-user activity to the bureaus—otherwise, the child won’t build credit. Always review the card’s terms or call customer service for your specific policy.

Final thoughts

Understanding the building blocks of credit and recognizing readiness cues can turn the credit-card milestone from a leap of faith into a strategic move.

After turning 18 or beyond, you might ask how old do you have to get a credit card or reflect on at what age can you get a credit card to maximize opportunities.

Knowing how old to get a credit card is only half the battle—behavior shapes success. With these principles in place, you’ll be well on your way to establishing—and sustaining—a strong credit foundation.

Sources

Author

Brian Flaherty

Brian is a graduate of the University of Virginia where he earned a B.A. in Economics. After graduation, Brian spent four years working at a wealth management firm advising high-net-worth investors and institutions. During his time there, he passed the rigorous Series 65 exam and rose to a high-level strategy position.

Editor

Rachel Lauren

Rachel Lauren is the co-founder and COO of Debbie, a tech startup that offers an app to help people pay off their credit card debt for good through rewards and behavioral psychology. She was previously a venture capital investor at BDMI, as well as an equity research analyst at Credit Suisse.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today

Compare Personalized Rates